Debt-to-Equity Ratio: Formula, Analysis and Examples

In financial analysis, the debt-to-equity ratio (D/E ratio or “gearing” as it is known in the UK) is an important financial risk metric that provides valuable insights into a company’s financial health. This ratio is one of a group used by analysts, and creditors to assess the risks posed to a company by its capital structure.

Article Contents

- What is the Debt-to-Equity Ratio?

- Gross or Net?

- Formula for Calculating Debt-to-Equity Ratio

- What is included in Total Debt?

- Other Debt: What about Leases? Are Pensions Debt?

- Debt/Capital Ratio

- Be Careful of Definitions

- Interpreting the D/E Ratio

- Industry-specific Debt Considerations

- Examples and Case Studies for Debt-to-Equity Ratio

Key Takeaways

| Aspect | Description |

| Definition | The debt-to-equity ratio compares a company’s total debt to its total shareholders’ equity. It provides insights into the company’s financial leverage and risk. |

| Formula |

|

| Interpretation | Lower ratios are generally more favorable, indicating lower reliance on debt financing. However, industry norms and capital needs must be considered. |

| Components of Total Debt |

|

| Industry Considerations |

|

| Analysis Caveats |

|

What is the Debt-to-Equity Ratio?

The debt-to-equity ratio compares a company’s total debt, i.e. the capital that it has borrowed to its total shareholders’ equity, or rather the capital subscribed by shareholders or not distributed from profits but left in the firm. A higher debt-to-equity ratio indicates that a company is more leveraged and relies more heavily on debt financing, while a lower ratio suggests a greater reliance on equity financing. If we take the FTSE 350 in the UK, the average debt/equity ratio is less than 50%. Generally, equity investors will start to pay attention to this ratio if it gets above 100%. In the world of private equity, ratios of 150-250% are common.

Gross or Net?

In considering debt/Equity ratios it is important to look on a Net basis, i.e. subtracting cash on the balance sheet from the debt figure, as well as looking on a gross basis. Many large companies operate with substantial cash balances, so the “gross” ratio can overstate the risk.

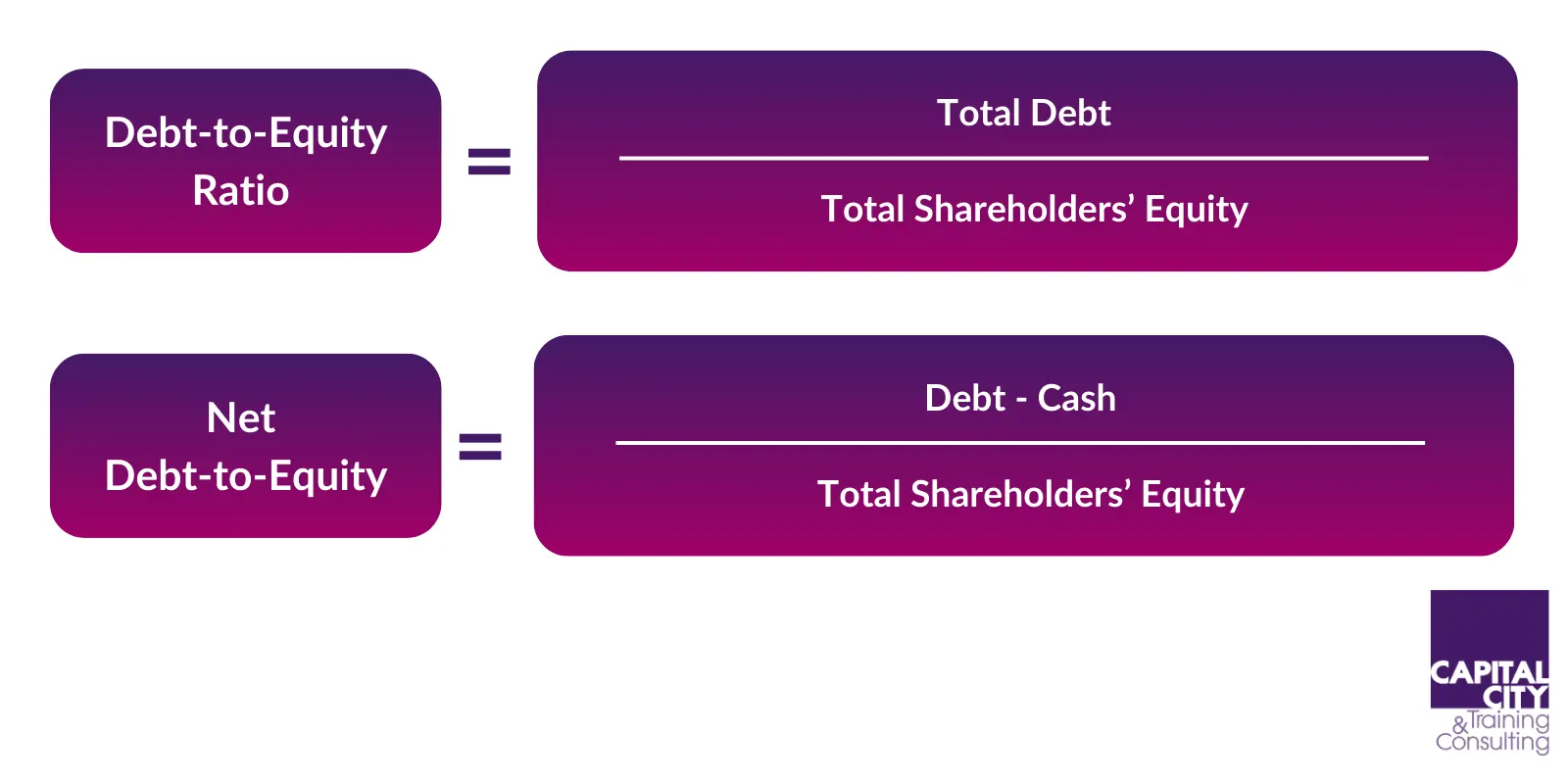

Formula for Calculating Debt-to-Equity Ratio

The debt-to-equity ratio is calculated using the following formula:

Debt-to-Equity Ratio = Total Debt / Total Shareholders’ Equity

And:

Net Debt-to-Equity = (Debt – Cash)/ Total Shareholders’ Equity

Where:

- Total Debt – the sum of all short-term and long-term debt obligations, including loans, bonds, and other borrowings.

- Total Shareholders’ Equity – the sum of all equity accounts, such as common stock, retained earnings, and additional paid-in capital.

What is included in Total Debt?

When calculating the debt-to-equity ratio, it is essential to consider all forms of debt, including:

- Short-term debt: This includes obligations that are due within one year, such as accounts payable, short-term loans, and the current portion of long-term debt.

- Long-term debt: This refers to obligations that have a maturity date beyond one year, such as bonds, mortgages, and long-term loans.

Other Debt: What about Leases? Are Pensions Debt?

Depending on the industry and the company’s specific circumstances, other forms of debt, such as leases, may be substantial obligations. This is usually the case in a sector like retail. Under international accounting standards all leases are capitalised. This means the present value of the minimum lease payments is shown on the balance sheet as debt. If this is split out on the balance sheet (i.e. not included under the debt heading) be sure to add it into the total debt.

As always with ratios, the devil is in the detail: Under UK GAAP (used by most small to medium sized companies) not all leases are capitalised, so there is potentially hidden debt. The market practice for estimating this “missing debt” is to take the annual lease payment and multiply by 7 or 8. This is a quick and dirty way to estimate the capital value of a 10-year lease with an interest rate of 5-6%.

In calculating Debt/Equity you should also be mindful of Pension liabilities. Whilst not strictly speaking debt – a company will have much more flexibility over how it meets these obligations over time – if pension liabilities are material, it is a good idea to calculate the Debt/Equity ratio a second time, including pensions.

Debt/Capital Ratio

A variant on this ratio is the Debt/Capital ratio which is simply Debt/(Debt+Equity). This is the preferred ratio used by the credit rating agencies to express the level of balance sheet “gearing”. When the agencies publish their key metrics and the broad ranges for each rating category, debt/capital is one of the four principal metrics they use along with:

- Debt/EBITDA

- EBITDA/Interest cover

- FFO/Net debt – (FFO meaning Funds from Operations)

Be Careful of Definitions

Different analysts in different countries can use the same name – for example leverage ratio in different ways. There is no generally accepted definition, so be careful you know what the particular analyst or firm’s standard definition is.

Interpreting the D/E Ratio

The interpretation of the debt-to-equity ratio is straightforward. Generally, a lower debt-to-equity ratio is more favourable. Debt is attractive to shareholders, it potentially will “lever up” their returns. Debt is cheaper than equity and interest is tax deductible. So, borrowing instead of putting in equity increases returns to shareholders. However, debt comes with “Fixed charges”: A borrower must pay interest and meet scheduled repayments or else potentially lose its business through bankruptcy. As well as “levering up returns”, when operating profit falls, debt amplifies the fall in profits.

To get an overall picture of financial risk in a business, you will not just have to consider Debt/Equity but also:

- The strength of the company’s cashflow

- Its liquidity

- Its profitability.

It is essential in any ratio analysis to consider industry norms and the typical capital needs of companies in our sector:

Industry Norms

Different industries have varying capital requirements and risk profiles, leading to different acceptable levels of debt-to-equity ratios. A steel manufacturer will struggle to keep an investment grade rating with only the most minimal amounts of debt, because of the cyclicality of the industry. A pharmaceutical company with a strong product portfolio could, in contrast have a lot of debt, so a debt/EBITDA of 4-5X (as opposed to zero for the Steel Company) and still be a strong investment grade. Similarly, capital-intensive but regulated businesses like utilities and telecommunications may have higher debt-to-equity ratios than service-based industries with similar credit ratings.

Interest coverage

While the debt-to-equity ratio provides insight into a company’s leverage, it is essential to consider the company’s ability to service its debt obligations. The interest coverage ratio, which measures a company’s earnings relative to its interest expenses, can provide additional context for interpreting the Debt-to-Equity ratio. More important in measuring financial risk in large established companies is the Debt/EBITDA metric. Credit ratings correlate much more strongly with this metric.

Industry-specific Debt Considerations

Different industries have varying capital requirements, risk profiles, and operating structures, which can impact the appropriate levels of debt-to-equity ratios. Here are some industry-specific considerations:

- Manufacturing: Companies in the manufacturing industry often require significant capital investments in plant, equipment, and machinery. As a result, they may have higher debt-to-equity ratios to finance these capital-intensive operations.

- Retail: Retailers typically have lower basic debt-to-equity ratios, as their business model is less capital-intensive, however these may have “hidden debt” in the form of operating leases depending on the accounting standards they apply.

- Technology: Technology companies, particularly those in the software and service sectors, may have lower debt-to-equity ratios due to their asset-light business models and reliance on intellectual property and human capital.

- Real estate: Real estate companies, such as developers and property management firms, often have higher debt-to-equity ratios due to the capital-intensive nature of their operations and the use of leverage to acquire and develop properties.

- Financial services: Banks and other financial institutions are subject to regulatory capital requirements, which can influence their debt-to-equity ratios. A bank is by definition highly leveraged: the banks own equity will be only a small proportion of its total equity and liabilities, the vast bulk of its financing coming from deposits. HSBC at the end of 2023 had equity of £192.6Bn, but deposits, bonds, lease and other debt of £2.154Tn. A debt/Equity of over 11X.

Examples and Case Studies for Debt-to-Equity Ratio

Example 1: Company A

Company A is a manufacturing company with the following financial information:

Total Debt: £500 million

Total Shareholders’ Equity: £250 million

Using the debt-to-equity ratio formula, we can calculate Company A’s debt-to-equity ratio:

Debt-to-Equity Ratio = Total Debt / Total Shareholders’ Equity

= £500 million / £250 million

= 2.0

Company A’s debt-to-equity ratio of 2.0 indicates that it has £2 of debt for every £1 of equity. This relatively high ratio suggests that Company A is highly leveraged and relies heavily on debt financing. In the context of the manufacturing industry, where capital-intensive operations are common, this ratio may be considered acceptable, but further analysis of the company’s interest coverage and cash flow would be necessary to assess its ability to service its debt obligations.

Example 2: Company B

Company B is a technology company with the following financial information:

Total Debt: £100 million

Total Shareholders’ Equity: £800 million

Using the debt-to-equity ratio formula, we can calculate Company B’s debt-to-equity ratio:

Debt-to-Equity Ratio = Total Debt / Total Shareholders’ Equity

= £100 million / £800 million

= 0.125

Company B’s debt-to-equity ratio of 0.125 indicates that it has £0.125 of debt for every £1 of equity. This relatively low ratio suggests that Company B is not heavily leveraged and relies more on equity financing. In the technology industry, where companies often have asset-light business models and rely on intellectual property and human capital, this low debt-to-equity ratio may be considered favourable, as it reduces the company’s financial risk and provides greater financial flexibility.

Case Study: Assessing Debt-to-Equity Ratios for Investment Decisions

In the world of investment analysis, understanding and comparing debt-to-equity ratios across companies and industries is crucial for making informed decisions. Consider the following case study:

An investment firm is evaluating two companies, Company X and Company Y, operating in different industries. Company X is a telecommunications company with a debt-to-equity ratio of 1.5, while Company Y is a consumer goods company with a debt-to-equity ratio of 0.8.

At first glance, Company Y’s lower debt-to-equity ratio may seem more favourable. However, the investment firm must consider the industry norms and capital requirements for each company. The telecommunications industry is known for its capital-intensive operations, requiring significant investments in infrastructure and equipment. As a result, a debt-to-equity ratio of 1.5 for Company X may be within acceptable levels for the industry.

On the other hand, the consumer goods industry is typically less capital-intensive, and companies in this sector may have lower debt-to-equity ratios. In this context, Company Y’s debt-to-equity ratio of 0.8 could be considered relatively high, indicating a higher reliance on debt financing compared to its industry peers.

The investment firm would need to conduct further analysis, including examining the companies’ interest coverage ratios, cash flow statements, and growth prospects, to fully evaluate the appropriateness of their debt levels and make an informed investment decision.

The debt-to-equity ratio is a powerful tool for financial analysis, providing insights into a company’s capital structure, financial leverage, and risk profile. By understanding the formula, interpretation, and industry-specific considerations of the debt-to-equity ratio, investors, analysts, and creditors can make more informed decisions regarding investments, lending, and risk management.

It is essential to recognize that the debt-to-equity ratio should not be evaluated in isolation but rather in conjunction with other financial ratios and qualitative factors. A comprehensive analysis that considers industry norms, growth prospects, cash flow generation, and overall financial health is necessary to effectively utilize the debt-to-equity ratio in financial decision-making.