Gearing Ratio Explained: Definitions, Formulas, and Examples

Gearing ratio is an important financial metric that measures the level of debt used to finance a company’s assets and operations relative to equity. The gearing ratio gives insight into a company’s financial leverage and helps evaluate its financial risk.

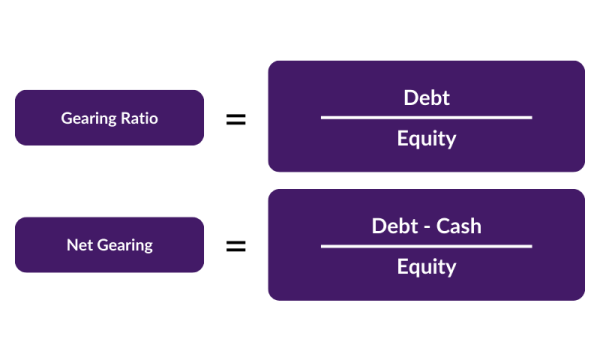

It doesn’t have an agreed textbook definition however, and it is often conflated with the leverage ratio. In the UK equity markets, the common meaning and formula for the “gearing ratio” is the ratio of:

Gearing = Debt/Equity.

Net Gearing = (debt less cash)/Equity.

It is an important financial risk metric. For corporates, i.e. non-financial companies, a ratio of less than 100% is considered normal. The average for UK listed non-financial companies is 56%.

A higher gearing ratio means the company is more reliant on debt financing, while a lower ratio means it is financed mostly through equity. Anything above 100% indicates higher financial leverage and risk.

Article Contents

Gearing Ratio Key Takeaways

| Aspect | Takeaway |

|---|---|

| Definition | Measures a company’s debt relative to equity. Higher ratio indicates greater financial leverage and risk. |

| Formula | Gearing Ratio = Debt / Equity |

| Interpretation | Moderate gearing is <50%. High gearing is >100%. Compare to industry averages. |

| vs Leverage Ratio | Leverage ratio measures debt to capital or debt to EBITDA, different metrics. |

| Analysis | Consider alongside interest coverage, liquidity, growth plans, industry and macro conditions. |

What is the Gearing Ratio not?

The gearing ratio, or debt/equity is often mixed up with the leverage ratio, which most commonly is taken to mean one of two things: when discussing the balance sheet “Leverage” or the “Leverage Ratio” usually means the ratio of debt/Capital:

Balance sheet leverage = Debt/(Debt +Equity).

In the leveraged finance market, “Leverage” is usually referring to “cashflow leverage” – the ratio of debt/EBITDA:

Leverage = Debt/EBITDA,

Net leverage = (Debt net of cash)/EBITDA

While there are different definitions in different context, the important thing is to look at the context and infer what definition is likely In use. If an exact definition is required, for example in a loan document, then there will be a Capitalised Ratio Name and an Agreed Definition, always spelt with Capitals in the document.

How to calculate Gearing Ratio in Excel

Here’s a step-by-step guide to calculating the gearing ratio in Excel:

- Enter the total debt amount, including both short and long-term debt.

- Input the cash and cash equivalent balance.

- Calculate net debt by subtracting cash from total debt.

- Enter the total shareholders’ equity amount.

- In a new cell, divide the net debt by total shareholders’ equity.

- Format the result as a percentage to get the gearing ratio.

Gearing Ratio vs Other Financial Metrics

Gearing ratio is similar in purpose to other leverage and solvency ratios like the interest coverage ratio. However, there are some key differences:

The Interest Coverage Ratio measures the ability to cover interest expense from year to year rather than the overall solvency of a company. As interest rates rise, Interest cover is becoming a more important metric again. For many years when Central Bank’s pursued quantitative easing policies, interest rates were so depressed, that even in relatively leveraged companies, interest cover was not a problem. Now that interest rates have risen from negative numbers in Euros to 3%, interest cover is now indicative of real risk.

Interpreting the Gearing Ratio in Corporate Finance

When analysing a company’s gearing ratio, corporate finance professionals should consider it in the context of a broad group of financial risk measures, such as:

- Debt / EBITDA / EBITDA Interest Cover

- FFO / Net debt

Liquidity analysis should also be considered to see whether the company can meet its cash needs from its operating cashflow, existing cash balances and available undrawn committed facilities. How long can it meet those needs for if the business disrupted? :

- Industry Averages: These are useful to tell us a company’s risk profile. In large companies High gearing is often simply an indication of a policy decision by shareholders, rather than distress: Private Equity funds use as much leverage as they can. Comparing the financial risk profile against industry benchmarks can be helpful to show us the absolute level of risk, but also the relative vulnerability of a company to financial shocks. There are cases where conservatively financed companies have engaged in price wars during recession, bringing down more highly leveraged peers, who were unable to service debt from their reduced cashflow.

- Trends: Look at changes in the gearing ratio over time to see if risk is increasing or decreasing. Again this may be a policy decision by shareholders to optimise capital structure by returning capital to shareholders. Why are the ratios changing is the important question.

- Growth Plans: Understand if the company needs higher leverage to fund expansion plans and acquisitions. If the company is highly leveraged, is that appropriate given its capital intensity and growth plans?

- Macro Conditions: Consider the overall economic environment and outlook on interest rates. Is risk increasing ? Or moderating?