Pecking Order Theory: Definitions, Concepts and Examples

Deciding how to finance a company’s operations and growth is a what corporate finance is all about! Companies must choose how to raise capital from various internal and external sources.

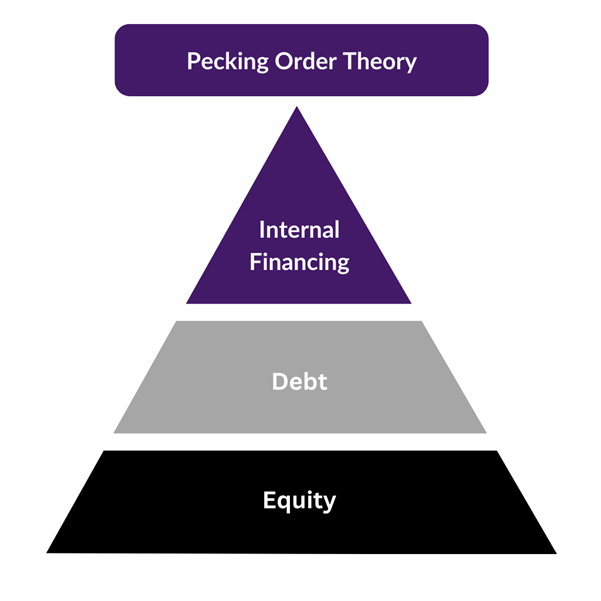

The pecking order theory provides an influential model for thinking about how companies make these financing decisions. Proposed by Stewart C. Myers and Nicolas Majluf in 1984, the theory suggests companies follow a defined hierarchy, prioritizing internal funds first, then debt, and finally equity as a last resort.

Understanding the pecking order theory gives insight into corporate capital structure choices and has important implications for financial modelling and analysis. While the theory has limitations, it remains a foundational framework for evaluating financing options.

What is the Pecking Order Theory?

The Pecking Order Theory, sometimes referred to as the capital structure pecking order, was first proposed by Stewart C. Myers and Nicolas Majluf in 1984. It aims to provide a model for how companies prioritise their financing sources and make capital structure decisions.

According to the pecking order theory, companies follow a hierarchy when making decisions about their capital structure:

- Internal Financing or Retained Earnings – Firms prefer to use internally generated funds to finance new projects and investments. This allows them to avoid the need for external financing which requires additional transaction costs.It’s also convenient as the company doesn’t need to go external investors (banks, institutions, shareholders) to get permission.

- Debt – If internal financing is insufficient, firms will issue debt in some form – utilising headroom on existing facilities, getting new loans from banks, or issuing bonds of some variety. Debt, as opposed to raising new equity capital, allows companies to obtain financing while avoiding giving up ownership or control.

- Equity – Issuing new equity is seen as a last resort in the pecking order. This can dilute ownership and requires sharing control with new shareholders.

The logic behind this pecking order is that internal funds have no associated costs while debt financing is cheaper than equity financing in most cases. Firms also wish to retain control and avoid ownership dilution.

Reasoning Behind the Pecking Order

The logic underpinning the pecking order theory extends beyond just the associated costs of each financing type. Several key reasons underlie this hierarchy:

- Information Asymmetry – Firms typically possess more information about their prospects and risks than external investors. When a company issues new equity, this is typically done when markets are buoyant and stock prices relatively high, so external investors may perceive it as a signal that the company believes its stock is over-valued. Just the announcement of a firm raising equity could actually damage the share price.

- Transaction Costs – Relying on internal financing avoids the transaction costs associated with issuing new debt or equity. Even between debt and equity, issuing debt typically has lower flotation costs.

- Control and Ownership Dilution – By using internal funds or debt, companies can prevent dilution of ownership. Issuing new equity can lead to a dilution of control of existing shareholders and may result in management having to answer to a broader group of shareholders. Family-controlled businesses are particularly sensitive to bringing in new shareholders.

- Cost of the finance – Debt is fundamentally cheaper than equity! It’s less risky for investors (with scheduled repayments of interest and principal) and has priority over equity on liquidation. It may also be secured over business assets making it even cheaper. In addition to all that, interest payments on debt are tax-deductible, making debt an attractive option from a tax perspective. Equity does not offer such tax advantages.

Real-World Examples

There are many real-world examples that illustrate the pecking order theory in action:

- Apple, for instance, has generated significant retained earnings in recent years. Instead of accumulating extensive external debt or issuing new equity, the tech giant has largely relied on these internal funds to finance ventures like R&D, capital expenditures, and acquisitions. However, it’s also worth noting that in certain circumstances, even major corporations like Apple may deviate from the pecking order, based on market conditions or strategic initiatives.

- Mature manufacturing firms rely heavily on corporate bonds and debt offerings to fund expansions. This allows them to maintain control and avoid issuing equity.These businesses also tend to be quite asset intensive, providing scope for debt to be secured over those tangible assets.

- High-growth startups exhaust their limited debt capacity quickly. When cheaper debt financing runs out, they turn to more expensive external equity investors like venture capitalists who command high returns (not necessarily in cash, but in seeing growth in their capital).

These examples show the pecking order theory largely holds when explaining corporate capital structure decisions across different contexts. Firms stick to the hierarchy when possible.

What are the Advantages of Using the Pecking Order Theory?

Using the pecking order theory to guide financing decisions has some benefits:

- Avoiding loss of control and dilution – Using internal funds allows firms to maintain existing ownership and control structures.

- Reduced financing costs – Internal funds and debt are typically cheaper sources than equity financing.

- Flexibility for future investments – Using less debt preserves borrowing capacity for future needs.

- Reduced information asymmetry – Debt requires sharing less private data than issuing equity.

Overall, the theory provides a model to manage the costs of external capital by utilizing cheaper internal funds first. This can lower a firm’s overall cost of capital, and lowering costs of any kind is always a good option if you aim to maximise shareholder value.

Limitations of the Pecking Order Theory

However, the pecking order theory also has some limitations:

- Oversimplifies complex decisions – A rigid hierarchy fails to capture real-world factors that affect capital structure.

- Applicable mainly to established public firms – less mature or private firms often lack access to cheaper internal and debt financing.

- Ignores benefits of equity – Firms may issue equity to strategically align with investors or when shares are overvalued.

- Static view – Changing market conditions affect the relative costs of debt and equity over time.

- Using internal funds may disturb the dividend pattern of a company. Many equity investors like dividend reliability, and if the pecking order theory is applied blindly it might mean lower dividends – leading to lower share price and damaging the share price.

While useful as a general framework, the pecking order theory oversimplifies nuanced financing decisions. In practice, multiple factors beyond just cost and control impact optimal capital structure. Companies weigh trade-offs based on their specific situation – How much do they need? What is it being used for? How leveraged is the business already? And so on.

Alternatives to the Pecking Order Theory

The Pecking Order Theory provides a hierarchical framework for financing decisions, but other theories offer contrasting views:

- Trade-off Theory – This theory suggests that firms balance the benefits and costs of debt financing to find an optimal capital structure. For instance, while debt can provide tax shields, it also increases the firm’s risk of bankruptcy.

- Agency Theory – This focuses on the conflicts of interest between shareholders and managers. Managers may prefer to finance operations without resorting to external financing to maintain job security, whereas shareholders might prefer riskier strategies that require external financing but offer higher returns.

- Market Timing Theory – Some researchers argue that the timing of equity markets influences financing decisions. Firms might issue equity when they believe their stock is overvalued and repurchase equity when they believe it’s undervalued.

Capital City Training offers face-to-face programs and online financial training courses covering Corporate Finance decision making and exploring the Capital Market financing options – from Syndicated Loans to Bonds and Equity. Contact us if you would like to discuss arranging or attending one of our programs.