New Year, New Tariffs – 31-01-25 – MMT Analysis

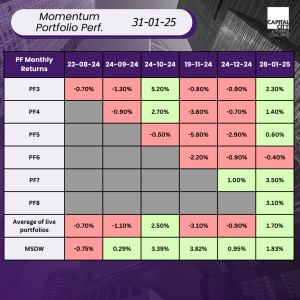

This is the eighth month of running our momentum portfolios and performance has been mixed again:

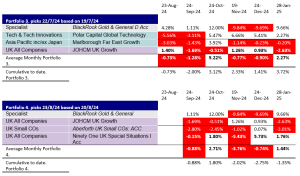

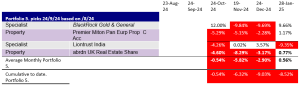

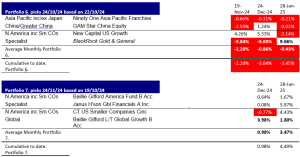

What are the factors driving the performance? Here are the individual portfolios:

US Stocks, Banks and Tariffs

The US continues to perform strongly in the wake of Trump’s inauguration, but the threat of tariffs from the Trump Government is damaging other markets: China and India are both badly affected.

At the time of writing (Jan 31st) tariffs have been imposed on China and threatened against the EU. The dispersion of returns between the US and the rest of the world may stay large. The latest portfolio has performed well because of its concentration in the US. Janus Henderson Global Financials is 60% US. The outlook for banks is good and for US banks in particular.

Exposure to China in some of the portfolios shows the risks of a pure momentum strategy. China’s Government stimulus in the autumn of 2024 gave a great one-off boost, but performance is now stagnant.

One other impact of the aggressive start to President Trump’s second term is a strong performance by gold and gold stocks.

Central banks have been increasing gold reserves in recent years, but China, Russia, and other countries potentially in the firing line of US sanctions are accumulating gold as an alternative to the US dollar as a trade settlement currency. “De-dollarisation” by pariah states like Venezuela who settle oil trades in currencies other than the US dollar is an established trend.

It is perhaps ironic that we have done this experiment at a time when geopolitical events are causing dramatic changes in momentum in a very short time period.

Momentum in January and a new Eighth Portfolio

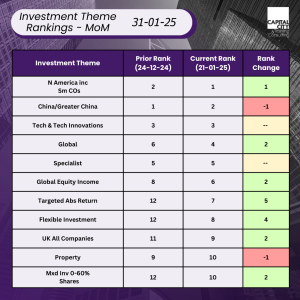

So, has the overall momentum picture changed much? Here are the top sector rankings: UK high yield has fallen from third place to very low in the rankings, thanks to the disruption in the gilt market.

The analysis predates the Deepseek market shock, so in February I expect the Tech sector to rank lower. I also expect China to fall as another month of lacklustre/poor performance will worsen the 6-month average.

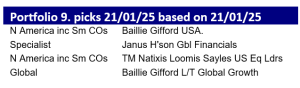

Portfolio Nine

This month, rather than taking a pure momentum approach, I will use some judgement to see if we can improve performance. I will not include China for the reasons cited above. The US and financials seem to have the best dynamics for now.

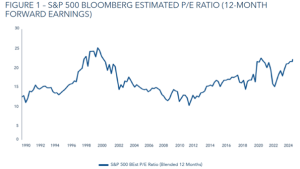

This pick is not without risk: the US market is expensive:

Although inflation came in below expectation in the US in January, inflation surprises or slower than expected falls in interest rates could damage performance. Further weakness in the “magnificent Seven” could spread to a broader correction. No return without risk!