Slowing US Performance – 28-03-25 – MMT Analysis

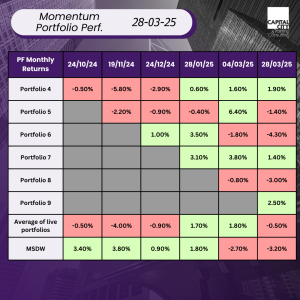

This is the tenth month of running our momentum portfolios and performance has been mixed again. However, for the 2nd month running our momentum experimental portfolios have all beaten the index.

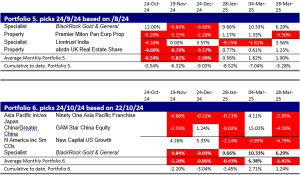

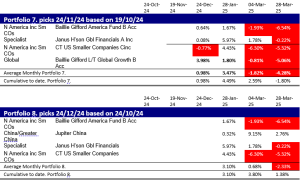

What are the factors driving the performance? Here are the individual portfolios:

All portfolios except no.7 have outperformed the index. Just like last month, because they all are less or non-US and tech biased. As we noted last month, beating this index means the US and tech underperform, while both have demonstrably done the opposite for a long time. The US is 2/3 of the SWDA index.

US Recession Worries

Have US equities stopped falling? The US market may have fallen form an average P/E of 30 to 27, but it is still well above long term average multiples of fifteen times. The disruption caused by President Trump’s tariff policies continues to reverberate through markets and the real economy: Consumer confidence is weakening, inflation is looking stickier and will perhaps rise as a result of tariffs, and investors are thinking about a US recession. None of the above are positive for US stocks.

EU Defence

In contrast, Europe has performed well, thanks in part due to the positive perceived impact of increased defence spending and the removal of fiscal constraints in Germany.

Defence stocks in particular have become so popular a trade a new ETF has been spawned in early March.

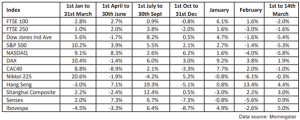

Absolute performance

Markets are starting to suffer in earnest with only Chinese, HK, Brazil, and some European markets ahead.

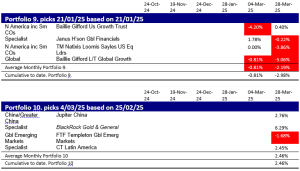

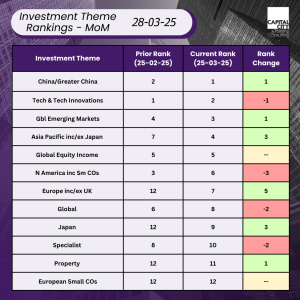

Momentum in March and a new eleventh Portfolio

Continuing with the change in approach we began last month, i.e. looking at short run momentum as well, how different does the story look and will that give us a different portfolio? If we look at the short run momentum, the top ranked sectors are:

- Greater China

- Gold and gold equities

- Japan

- European small companies.

This highlights the problem of the “specialist” heading – which is very broad, so we miss the great performance of gold. Secondly, we see the short run trend of European stocks which is stronger than the 6-month data suggest.

Portfolio Ten

Like last month, rather than taking a pure momentum approach, I will use some judgement to see if we can improve performance. I am now going to use 4-week momentum again to choose funds, and I am specifically going to underweight, i.e. ignore the US and tech on the basis that their momentum is now negative, even if that is not fully reflected in the 6-month momentum figures. Similarly emerging markets are not as strong as Europe.