A Soft Landing or a Hard Landing – MMT Analysis – 24-09-24

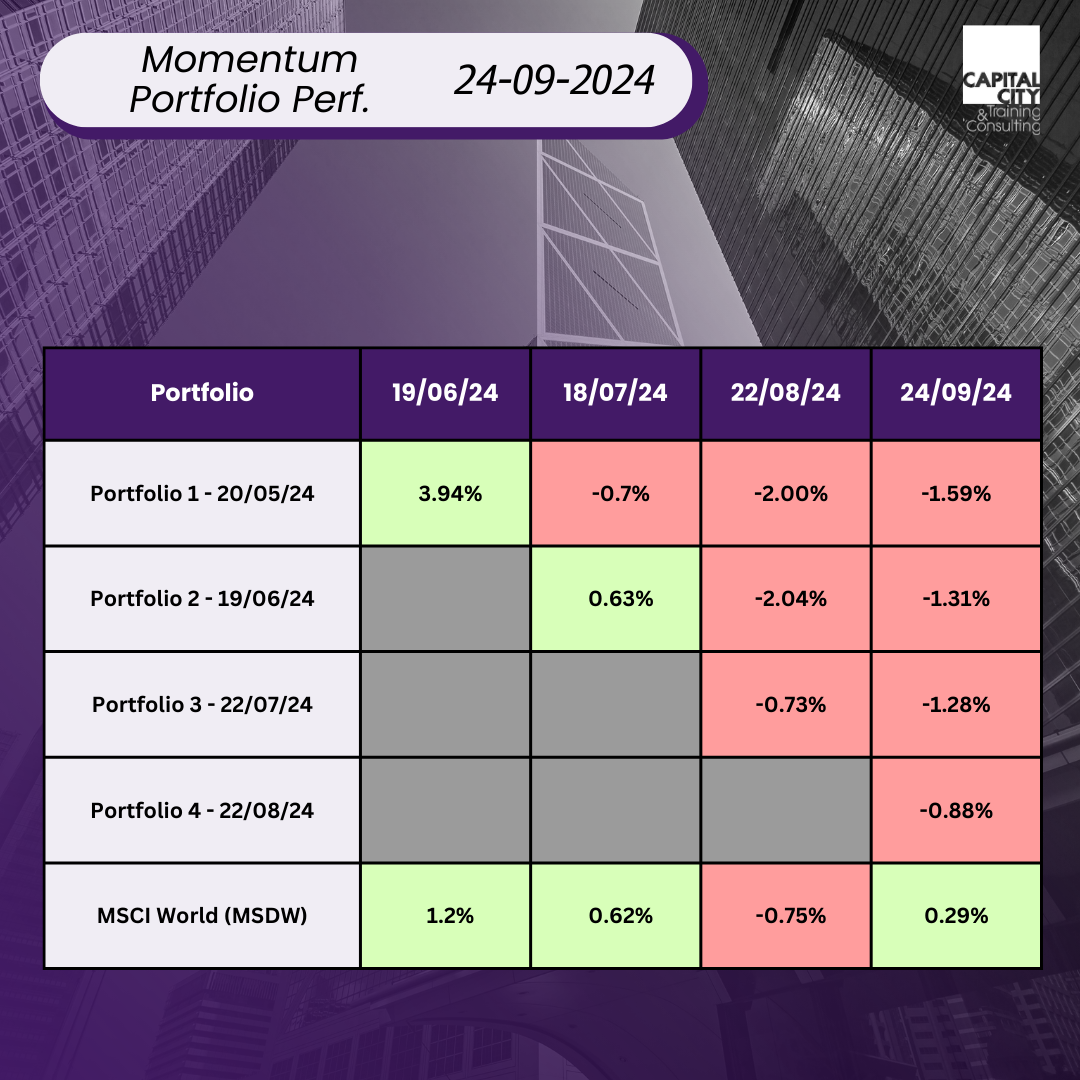

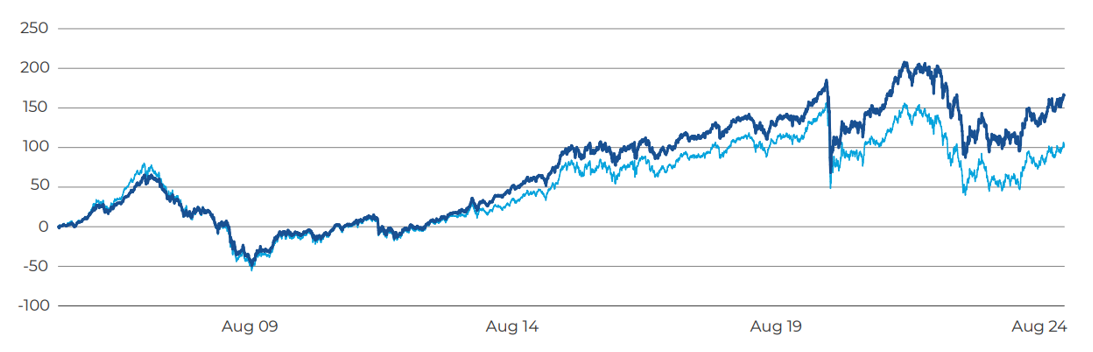

This is the fourth month of running our momentum portfolios and performance has already begun to diverge:

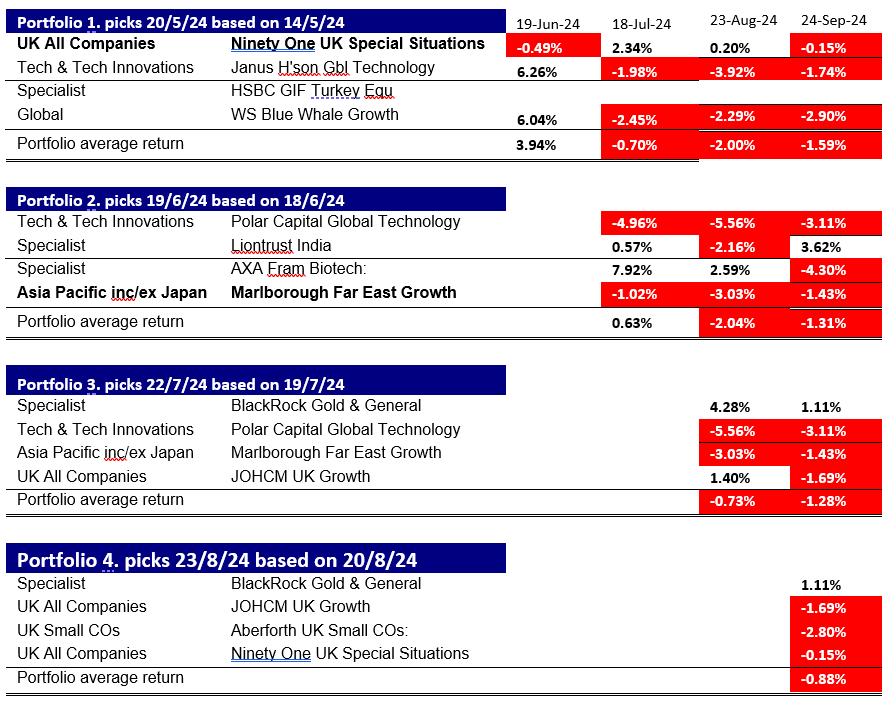

What are the factors driving the performance? Here are the portfolios:

After August’s painful lesson, the bad performance continues in September.

It remains to be seen whether we’ve reached a turning point in market sentiment, but technical factors and bad news conspired together to give a hugely volatile month.

More weak US data

The problems of August carried on in the US in early September, with weak manufacturing data upsetting traders.

September’s reputation as a bad month for stocks was affirmed.

How much will the Fed cut interest rates?

The big news for the month was the US interest rate cut. It was interesting talking to US-based bankers on the day, I was with a group of New Yorkers and Mexicans from Mexico City and Monterey. The consensus was for a 0.25% cut. It was difficult to make a positive narrative for stocks out if this: “if it’s 0.25% is it enough, the Fed is behind the curve. If it’s 0.5% it means the Feds are really worried, it’s worse than we think! A hard landing!” Everyone I spoke to seemed to discount the Fed getting it “about right” and voiding a recession.

Stocks did little on the day, then rose strongly the following day. Not enough, alas, to put the month into positive territory.

Where next? Previous cycles give mixed signals.

I am neutral to positive over the next twelve months: this US “loosening cycle” (of interest policy) is not driven by a financial crisis (2007); Global pandemic (2019); or a Far East Currency crisis, recession and Technology bubble collapse (2001). US fiscal policy looks set to remain generous irrespective of who is in the White House, so, barring problems elsewhere in the world – Ukraine, Israel – the outlook isn’t negative. Oil and natural gas prices are both weakening for now.

We can find similar articles about OPEC struggling with discipline and excess capacity.

Momentum in September

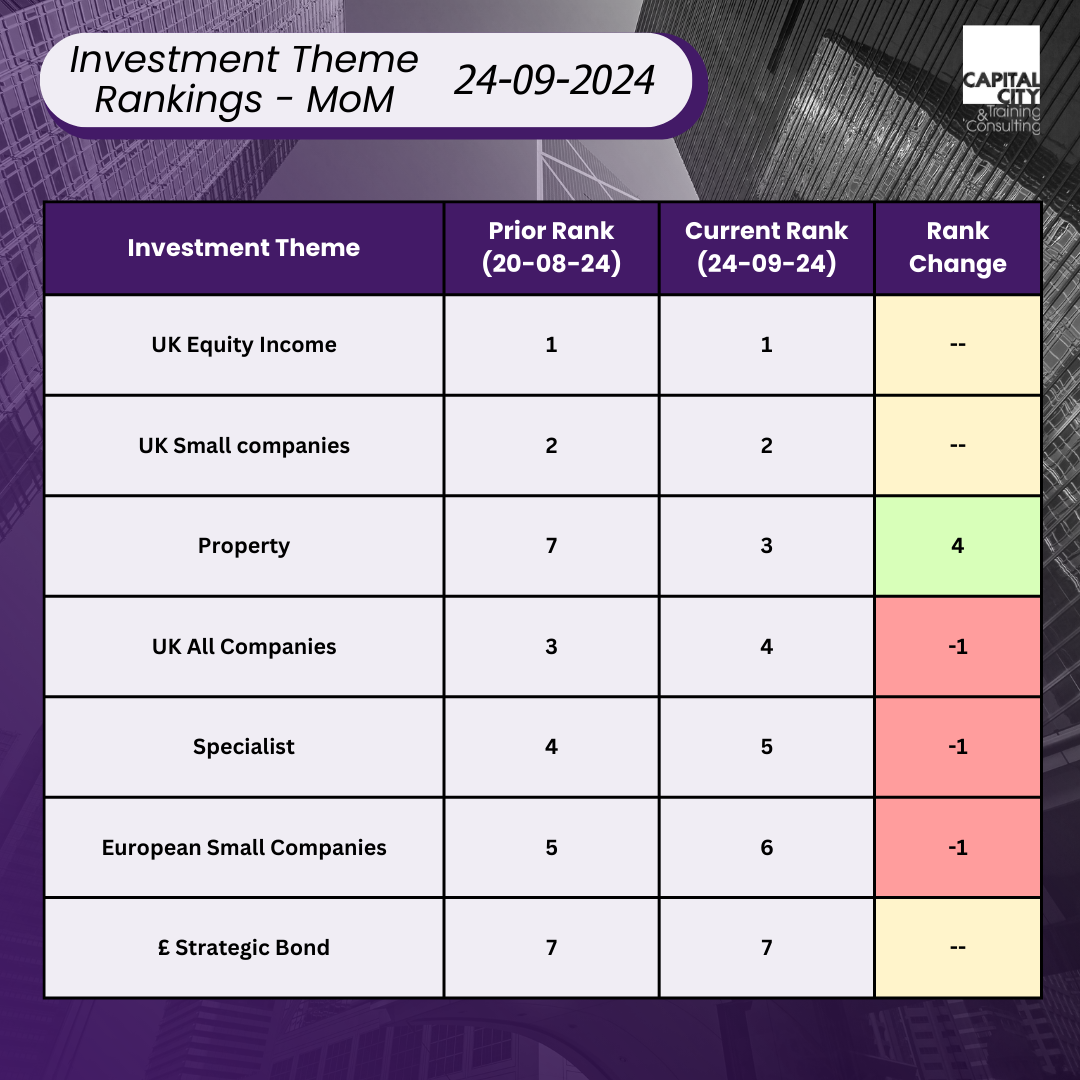

So, has the overall momentum picture changed much? Here are the top sector rankings:

Last month’s picture is not much changed: technology is still going backwards; the UK stays relatively strong.

We have to be careful here though when we talk about relative performance. Some of the funds with strong momentum over 6 months have fallen back over the last four weeks. Both of the top two categories of UK equity income and UK small companies have fallen 2-3% over the last four weeks. Falling interest rates in the UK have not been enough to offset the impact of the US data and the tax threats of the new labour government in the UK.

Specialist’s ranking at 4 hides the dominance of Gold and gold related stocks. Specialist covers a range of more esoteric strategies, but gold and gold mining funds, like Blackrock Gold and General are up almost uniformly over the last month. Interestingly retail investors seem to be selling gold, while central banks continue to buy.

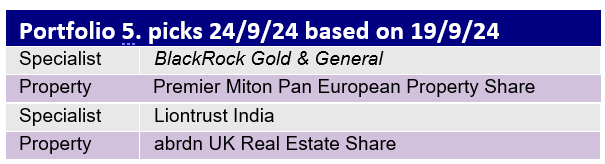

The new portfolio for September is as follows:

The interesting new addition is a pair of UK and pan-European property funds. The following chart shows the total return performance of the Premier Miton Pan European Property fund since its inception.

The historic yield of the fund is 3.13%. The COVID crisis; the subsequent slow return to work; the impact of lower footfall in the shorter working week; high inflation; and competition from internet shops has very adversely affected retail and commercial real estate valuations and perception. The fund pulled back between January and March, losing 10%, but this masked a continuing upswing. Perhaps now with interest rates falling, more investors will be attracted back at the relatively attractive valuations.

It will be interesting to see whether we will get to participate in this continued upswing or whether we are catching the end of a trend already nearly completed.