Enterprise Value: Definition, Formula and Examples

Enterprise value, often referred to as Firm value, represents the theoretical takeover price of a company. It is the total value that would be required to purchase a company outright – whether using debt or equity funding. The enterprise value definition encompasses not just the market value of equity but also includes debt net of any cash positions, providing a more holistic view of a company’s worth. It is a value of a business, regardless of how it is financed./p>

For example, if a company has a market capitalization (equity value) of £1 billion, £200 million in debt, and £100 million in cash, its enterprise value would be £1.1 billion (£1bn equity + £200m debt – £100m cash). This figure represents the actual cost an acquirer would need to pay to take control of the business (if they believed these values were ‘correct’!).

Article Contents

- Enterprise Value Formula and Components

- EV vs. Market Capitalization

- How to Calculate Enterprise Value

- EV/EBITDA Ratio: A Key Valuation Metric

- Understanding Negative Enterprise Value

- Applications of Enterprise Value in Finance

- Common Mistakes in Calculating Enterprise Value

- Comparing Enterprise Value Across Industries

- Enterprise Value Case Studies and Examples

- Practical Applications and Considerations

- FAQs

Key Takeaways

| Topic | Key Takeaways |

| Definition of Enterprise Value (EV) | Enterprise Value represents the total theoretical takeover price of a company, considering equity, debt, and cash positions. It provides a holistic view of a company’s worth beyond market capitalisation alone. |

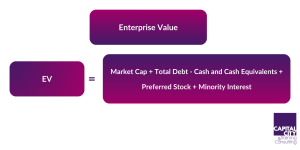

| EV Formula | EV = Market Capitalisation + Total Debt – Cash and Cash Equivalents + Preferred Stock value + Minority Interest value |

| Components of EV |

|

| EV vs. Market Capitalisation |

|

| How to Calculate EV |

|

| EV/EBITDA Ratio |

|

| Negative EV | Although very unusual, it will occur when cash exceeds market cap and debt. Indicates market distrust, investment opportunity, or cash-rich companies undervalued by the market |

| Applications of EV | Used in mergers and acquisitions, investment analysis, corporate finance, and private equity for valuations, peer comparisons, and strategic decisions |

| Common Calculation Errors |

|

| Industry Comparisons | EV varies by industry due to capital structures, debt levels, and operating metrics. Examples include capital-intensive industries (higher debt), tech (cash-rich), and retail (seasonal cash needs) |

| Practical Considerations | When using EV, consider industry norms, economic conditions, company-specific factors (e.g., growth stage), and ensure data accuracy |

Enterprise Value Formula and Components

The basic enterprise value formula is:

EV = Market Capitalisation + Total Debt – Cash and Cash Equivalents + Preferred Stock + Minority Interest (less JVs and Associate Investments in most cases, depending on definition)

Let’s examine each component:

- Market Capitalisation

a. Calculated by multiplying the current share price by the number of outstanding shares

b. Represents the equity value of the company - Total Debt

a. Includes both short-term and long-term debt

b. Comprises bank loans, bonds, and other debt instruments - Cash and Cash Equivalents

a. Includes readily available cash

b. Short-term investments and marketable securities

c. Subtracted because an acquirer would have immediate access to these funds - Preferred Stock

a. Added because preferred shareholders have priority over common shareholders

b. Represents a claim on the company’s assets - Minority Interest

a. Represents the portion of subsidiaries owned by minority shareholders

b. Added because it’s part of the overall enterprise value - JVs and Associate Investments

a. EV/EBITDA is the most commonly used EV ratio. EBITDA excludes any earnings from JVs and Associates and so, to make the ratio meaningful and comparable, EV should exclude the value of JVs and Associates

EV vs. Market Capitalization

Understanding the difference between market cap vs enterprise value is crucial for investors and analysts. While market capitalisation only considers equity value, enterprise value is a complete business valuation metric. Here are the key distinctions:

Market Capitalisation:

- Represents only shareholders’ equity

- Doesn’t allow for debt obligations

- Does include the value of financial assets including JVs \ Associate companies and other non-cash investments

- Can be very different to business / enterprise / firm value for highly leveraged companies

Enterprise Value:

- Includes both equity and net debt value

- usually excludes JVs and Associate investment value (but always check as different data sources have different definitions)

- Accounts for cash positions

- Provides a more accurate takeover value

- Better for comparing companies with different capital structures

How to Calculate Enterprise Value

-

- Gather Financial Information

a. Current stock price and shares outstanding

b. Total debt from balance sheet

c. Cash and cash equivalents

d. Preferred stock value

e. Minority interest figures (market value)

f. the value of JVs and Associate companies - Calculate Market Capitalisation

a. Multiply current stock price by number of outstanding shares - Add Total Debt

a. Include both short-term and long-term debt - Subtract Cash and Cash Equivalents

a. Remove liquid assets from the calculation - Add Additional Components

a. Include preferred stock and minority interest if applicable - Subtract the value of JVs and Associate companies if required

- Gather Financial Information

Example Calculation:

Company XYZ

- Market Cap: £500 million

- Total Debt: £200 million

- Cash: £50 million

- Preferred Stock: £20 million

- Minority Interest: £10 million

Enterprise Value = £500m + £200m – £50m + £20m + £10m = £680 million

EV/EBITDA Ratio: A Key Valuation Metric

The EV to EBITDA ratio is one of the most widely used valuation metrics in finance. This ratio compares a company’s enterprise value to its earnings before interest, taxes, depreciation, and amortisation (EBITDA).

Benefits of EV/EBITDA:

- Capital structure neutral

- Industry comparison tool

- Acquisition analysis metric

- Operating performance indicator

Typical EV/EBITDA ranges:

- 6-8x: Average valuation

- Below 6x: Potentially undervalued

- Above 8x: Potentially overvalued

- (Note: These ranges vary by industry and market conditions)

Understanding Negative Enterprise Value

A negative enterprise value occurs when a company’s cash and cash equivalents exceed its market capitalisation plus debt. While rare, negative enterprise value can indicate:

- Severe market distrust

- Potential investment opportunity

- Cash-rich companies with low market values

- Market inefficiencies

Causes of negative enterprise value:

- Market pessimism

- Recent large cash infusion

- Declining business fundamentals

- Temporary market dislocations

Applications of Enterprise Value in Finance

Enterprise value has numerous applications in finance:

- Mergers and Acquisitions

a. Determining purchase price

b. Comparing potential targets

c. Structuring deals - Investment Analysis

a. Company valuations

b. Peer comparisons

c. Industry analysis - Corporate Finance

a. Capital structure decisions

b. Financing alternatives

c. Strategic planning - Private Equity

a. Deal evaluation

b. Portfolio company analysis

c. Exit strategy planning

Common Mistakes in Calculating Enterprise Value

Several common errors can affect enterprise value calculations:

- Overlooking Debt Components

a. Failing to include operating leases

b. Missing pension obligations

c. Excluding contingent liabilities - Cash Consideration Errors

a. Including restricted cash

b. Overlooking working capital requirements

c. Misclassifying near-cash items - Market Cap Calculation Mistakes

a. Using incorrect share counts

b. Overlooking dilutive securities

c. Failing to account for recent corporate actions - Timing Issues

a. Using outdated financial statements

b. Mismatching dates for different components

c. Ignoring seasonal variations

Comparing Enterprise Value Across Industries

Enterprise value comparisons must consider industry-specific factors:

- Capital Intensive Industries

a. Higher debt levels

b. Significant fixed assets

c. Lower EV/EBITDA multiples - Technology Sector

a. Often cash-rich

b. Limited debt

c. Higher multiples due to growth potential - Financial Services

a. Complex debt structures

b. Regulatory capital requirements

c. Different valuation metrics needed - Retail Sector

a. Seasonal working capital needs

b. Operating lease considerations

c. Industry-specific metrics

Enterprise Value Case Studies and Examples

Case Study 1: Retail Company Acquisition

Company A considers acquiring Company B

- Market Cap: £300m

- Debt: £150m

- Cash: £50m

- EV: £400m

Analysis of purchase price and financing structure. The fair purchase price will be based on the EV – but recognise offer prices will be affected by many subjective factors (such as willingness to buy and future growth opportunities, meaning there may be a premium or discount to consider).

Case Study 2: Technology Company Valuation

High-growth tech firm analysis

- Cash-rich balance sheet

- No debt

- High EV/EBITDA multiple

- Impact of growth expectations on valuation

Case Study 3: Manufacturing Company Comparison

Comparing two competitors

- Different capital structures

- Various debt levels

- Industry-specific considerations

Demonstration of EV’s usefulness in peer comparison as EV is not impacted by capital structure.

Practical Applications and Considerations

When using enterprise value in practice, consider:

- Industry Context

a. Typical multiples

b. Capital structure norms

c. Growth expectations - Market Conditions

a. Interest rate environment

b. Economic cycle

c. Industry trends - Company-Specific Factors

a. Growth stage

b. Operating performance

c. Management quality - Technical Considerations

a. Data quality

b. Calculation methodology

c. Timing issues

Enterprise value remains a crucial metric in financial analysis and business valuation. Understanding its components, calculation methods, and applications is essential for finance professionals. While it has limitations, enterprise value provides valuable insights when used alongside other financial metrics and considered within appropriate context.

The comprehensive nature of enterprise value makes it an indispensable tool for:

- Mergers and acquisitions

- Investment analysis

- Corporate finance decisions

- Industry comparisons