A Month of Mixed Returns – MMT Analysis – 24-10-24

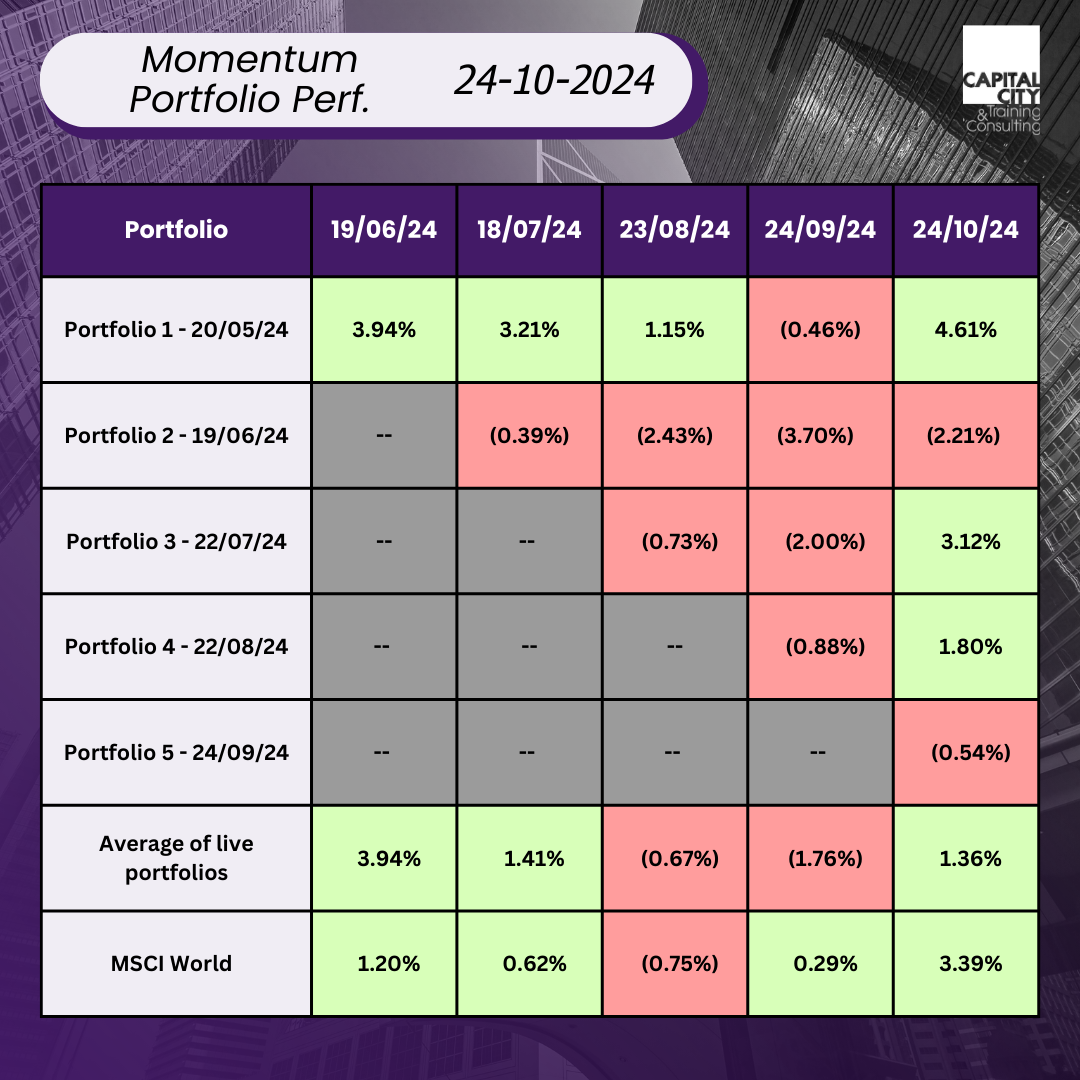

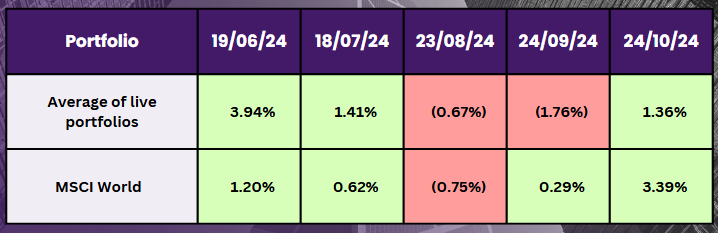

This is the fifth month of running our momentum portfolios and performance has been mixed again:

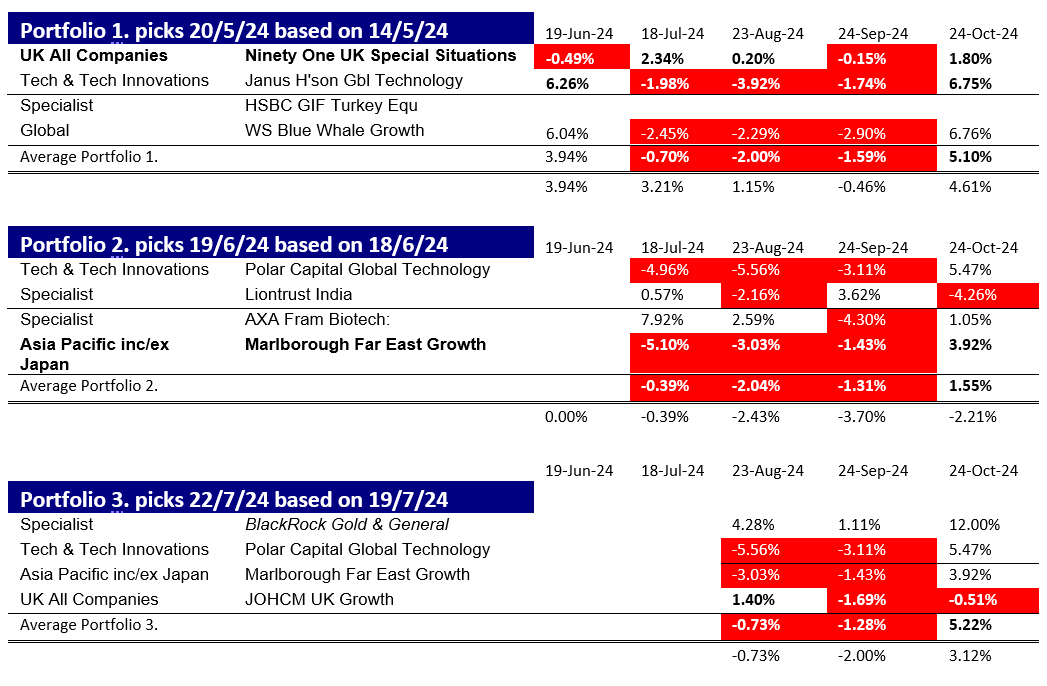

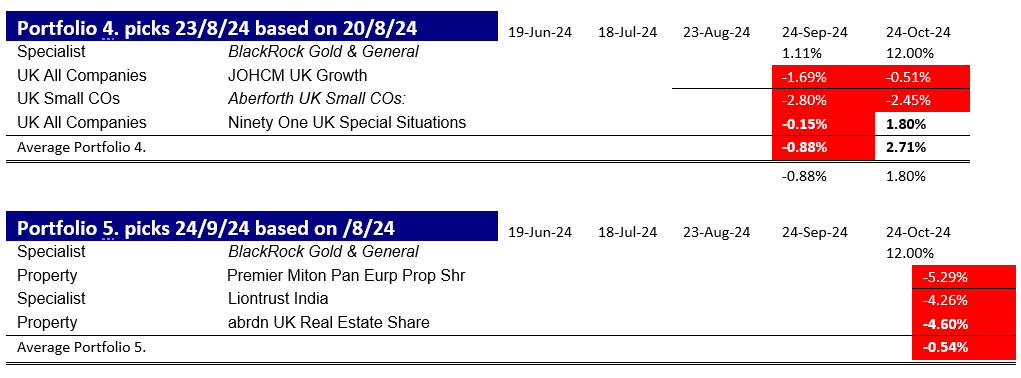

What are the factors driving the performance? Here are the portfolios:

After a painful August and September, October has bounced back, but not uniformly.

There have been conflicting drivers of markets which have affected different markets in different ways.

In summary:

- Iran’s second missile attack on Israel and Israel’s attack on Lebanon caused a wobble in equities and helped propel gold and gold-linked stocks up.

- Bank results suggested a possible “no -landing.” i.e. with growth continuing.

- The Chinese market responded dramatically to proposed stimulus from the Bank of China, rising 30% before falling back10%!

- Notwithstanding below target inflation in the UK at 1.7%, gloom prevails over the New Government and potential tax rises

- Finally, sentiment sems to be swinging back towards Trump in the US elections, which is perceived as inflationary, but with better growth for US companies.

The Dow Jones hit record highs at the end of the month and the dollar is rallying too.

Better US data?

Two of the US’ biggest banks, JP Morgan Chase and Wells Fargo and reported better than expected figures. They also suggested that data on credit cards indicated increasing consumers pending – the primary driver of the US economy.

Israel at War

The initial sell-off was recovered after the Iran attack and perception of oil price risk has also reduced. Markets seem to be getting inured to the conflict. Broader issue around discipline and excess capacity in OPEC and Israel’s stated intention to hit Iran’s military have likewise limited oil price moves.

I’ll repeat the links from last month: Oil and natural gas prices are both weakening for now.

China stimulus?

The most dramatic moves in the month came from China. The Chinese market has been depressed and cheap in P/E terms, reflecting the longer-term impact of the property crisis in China and the developing impact of trade frictions, international tensions and trends such as “near-shoring”. The market responded dramatically to the Government’s stimulus plans, rising 30%! Before falling back 10%.

US Elections

Opinion polls seem to indicate that Trump has narrowed the gap with Kamala Harris and perhaps even overtaken. The direction of markets and the Federal Reserve will likely be different depending on who wins.

Markets seem sanguine, with the Dow Jones hitting new records during the month.

Gold! Another stellar month

War in the Middle East, concerns over fiat currencies and continuing demand from China push gold ahead. BlackRock Gold and General returned 12% on the month. Gold in Sterling terms has returned 6%.

There is a broader issue around gold: reliance on the US dollar as the major trading currency is a weakness for China and Russia. Gold reserves provide an unimpeachable reserve base for a currency and a settlement route obviating the need for a bank with a US dollar clearing license. Demand for gold is unlikely to reduce as “de-globalisation” continues.

Momentum in October and a new fifth portfolio

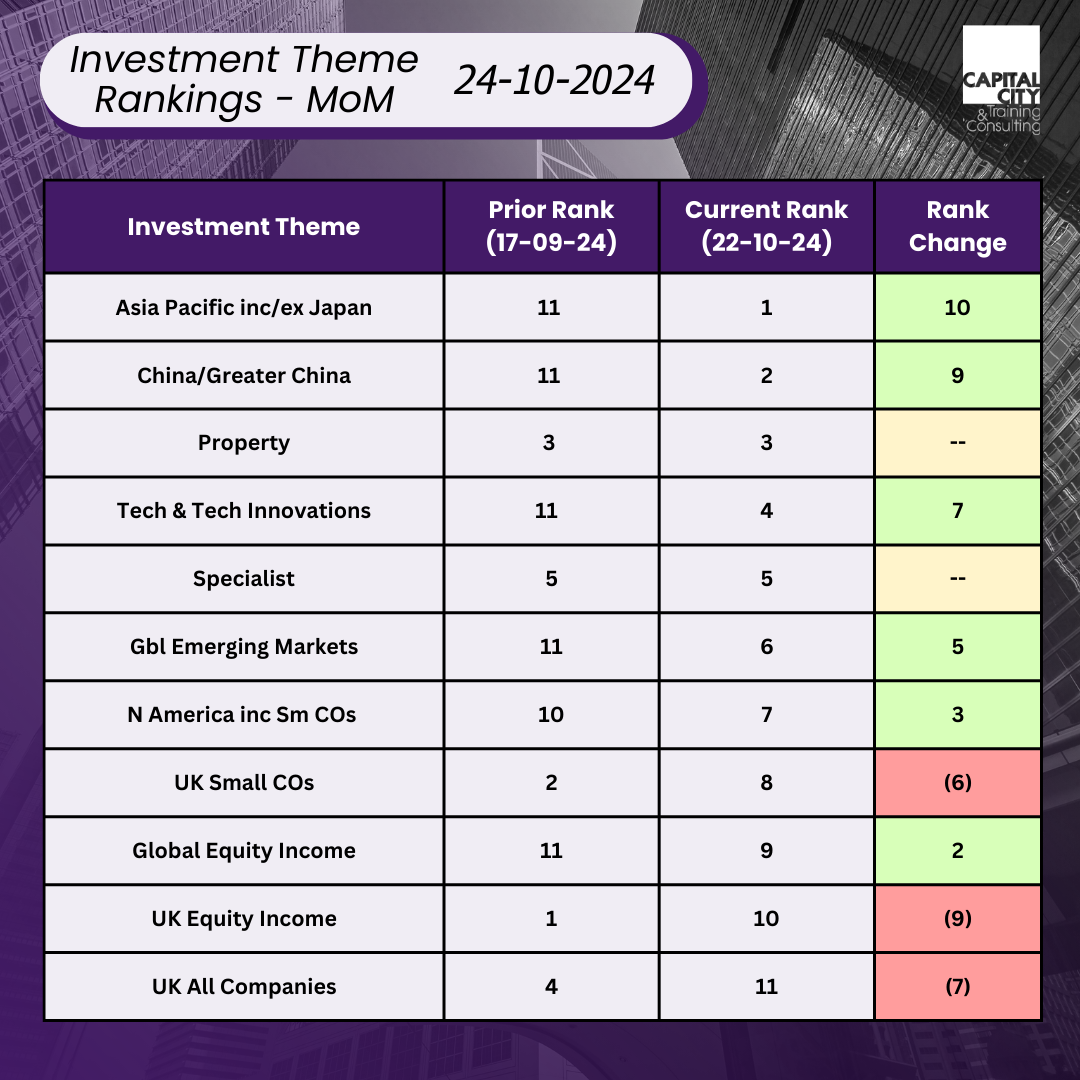

So, has the overall momentum picture changed much? Here are the top sector rankings:

Last month’s picture has changed a lot: China’s dramatic month has lifted it to number one and the Asia Pacific funds group with it. Property has had a big bout of profit taking so even though its position has stayed at 5, returns have been negative on the month.

Specialist’s ranking at 5 hides the very strong performance of Gold and gold related stocks. Specialist covers a range of more esoteric strategies, but gold and gold mining funds, like Blackrock Gold and General are up almost uniformly over the last month. Interestingly retail investors seem to be selling gold, while central banks continue to buy.

UK equity income and UK small companies continue to fall back. The new Government’s honeymoon lasted only days. The outlook for taxes and anti-business policy looks far worse than anyone imagined. Falling interest rates and now falling inflation haven’t turned sentiment.

Does momentum investing work?

Five months isn’t a very long-time horizon. The strategy has not been an embarrassment – it has outperformed in three out of five months.

It will be interesting to see how we do when we take account of transaction costs as we liquidate each portfolio at its 6-month anniversary. Perhaps what we are achieving here is showing the merits of a broad index like the MSCI world index (SWDA), which has strong weightings to all of the growth drivers in the momentum portfolios.

The new portfolio for October is as follows: