Tech, Trump and Gold – MMT Analysis – 18-07-24

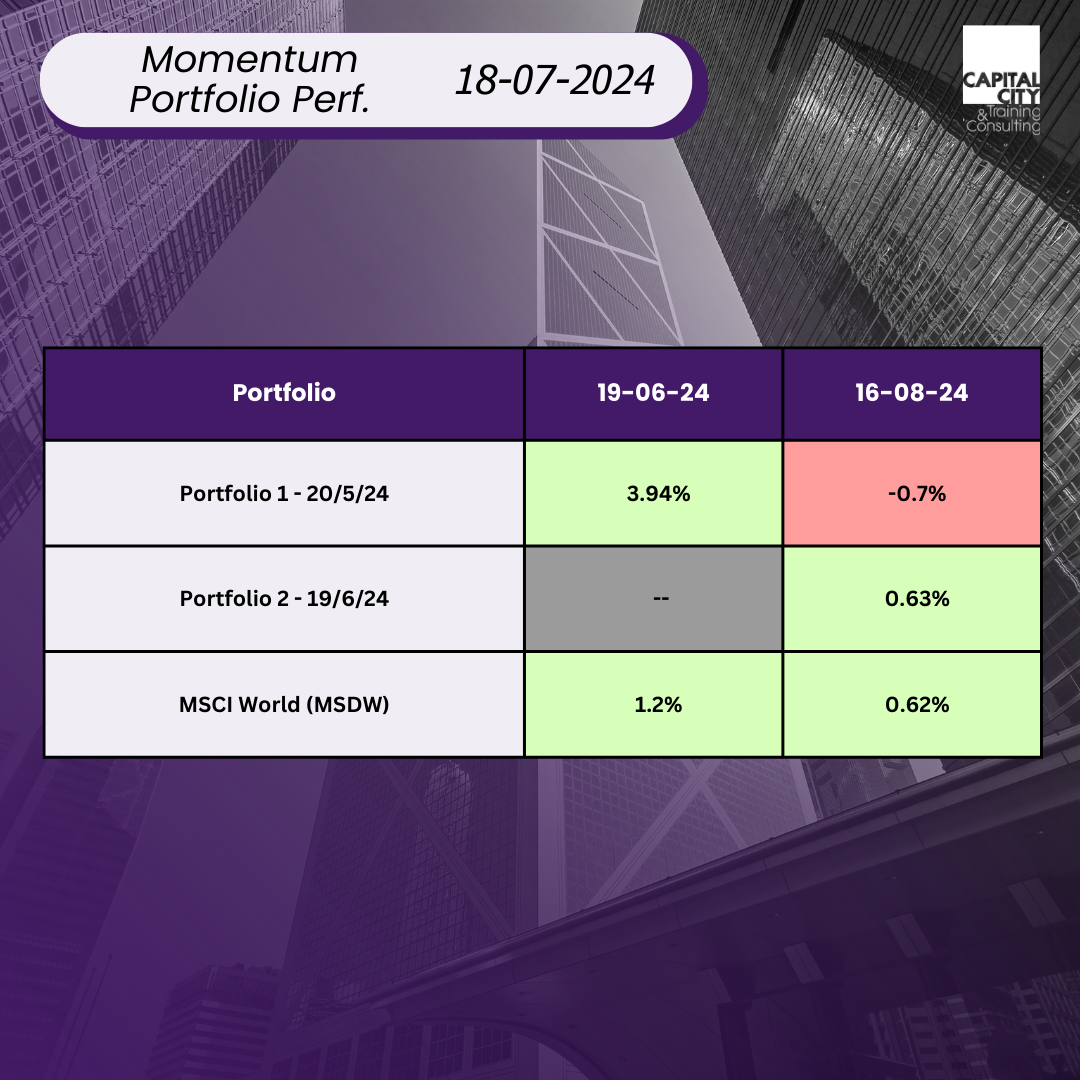

This is the second month of running our momentum portfolios and performance has already begun to diverge.

On a cumulative basis both portfolios are ahead of the MSCI World, but we can already see the volatility in this strategy!

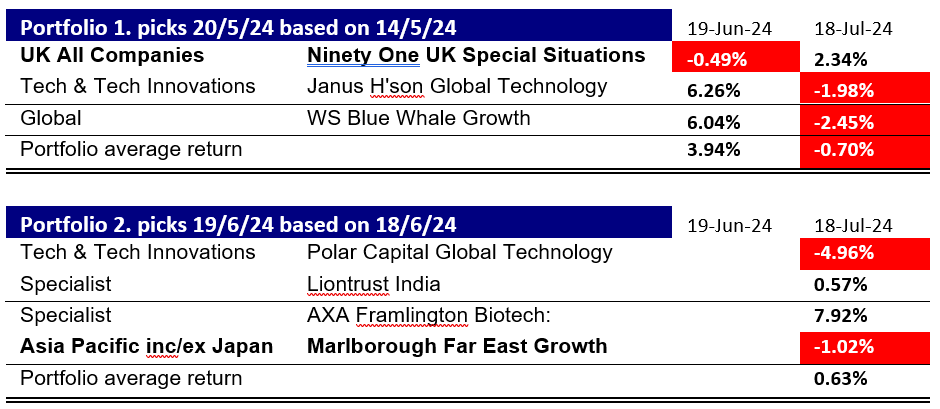

What are the factors driving the performance? Here are the portfolios:

18th July – The Worst Day for Tech in 2024

Clearly tech is the big problem. According to the Wall Street Journal, the day before month end saw the NASDAQ have its worst day in 2024, driven by the “Magnificent 7” stocks.

A consistent narrative in the press is that Nvidia in particular is priced to perfection, Tech corrected earlier this year, with Nvidia falling over 10% before recovering. After such a strong run of performance, the market is becoming more febrile – investors appear to be getting nervous and taking profits.

A very conventional portfolio strategy is “rebalancing” – target a mix of bonds and equities and as one grows faster– typically equities, sell equities and buy bonds to get back “ in balance.” Thiis typically enhances performance as investors on average keep selling expensive assets and buying the cheaper class. What we are doing isn’t inconsistent – we are hoping to capture outperformance and sell after a strong performance as markets overshoot. Well, that’s the idea we are testing.

Will August be better for tech? Unlikely, we’ve had the CrowdStrike “flash crash.”

Big rotation starting?

Linked to the profit taking idea is this story regarding stock market rotation. The Russell 2000 index, this ignores the top 1,000 companies listed in the US by size, has had a poor run over the last 3 years, but has suddenly outperformed the S&P 500. I have recently been looking at investing in this index, and S&P equally weighted funds. funnily enough, precisely because I am scared of owning expensive, potentially overvalued stocks like Nvidia. Even if they have given me super returns.

Is the start of a trend? The 2000 has returned 7.8% so far in 2024 – it is a good performance for the index which has averaged 6.9% over the last 10 years. It makes sense in conventional investor terms: when market conditions are tough – i.e. high interest rates- rotate into large caps and defensive stocks which are better able to weather higher finance costs. A cooling of inflation in the US implied by the 11th July inflation report implies earlier reduction in US interest rates. So, time to rotate back into cyclicals and small caps…i.e. the Russell 2000 stocks. Or if not wholesale- at least reduce exposure to (i.e. rebalance) the Magnificent 7.

The Trump Trade

The stories of President Biden’s infirmity and then Donald Trump’s defiant response to his shooting have moved opinion decisively in Trump’s favour. The implication of a Trump presidency are tariffs and tax cuts. This will be good for corporate America, even if it does create a resurgence in inflation in the longer term. Buying Russell 2000 stocks is a logical trade if you believe Trump will win the Presidency and congress.

What about the UK?

The wobbles caused by the election have subsided. We now have “stability” and continuing good macroeconomic news: Inflation good news, it is now at the Bank of England’s target of 2%, but interest rates stay high, the OECD believe that the UK will be the fastest growing OECD country this year and Sterling has gone to a new high against the dollar for 2024. All positive for stocks.

Biotech – what news?

The best performer of the month is the fund without a big macro story behind it. Axa’s biotech fund has had a great month. The only big story has been the successful $3.6Bn fund raising by Flagship Pioneering – the fund that launched Modena. In a difficult environment for VCs, which seems significant. Looking at funds in the sector, they are generally up 15-20% over the last year. Momentum is persisting!

Momentum in July and a New Third Portfolio

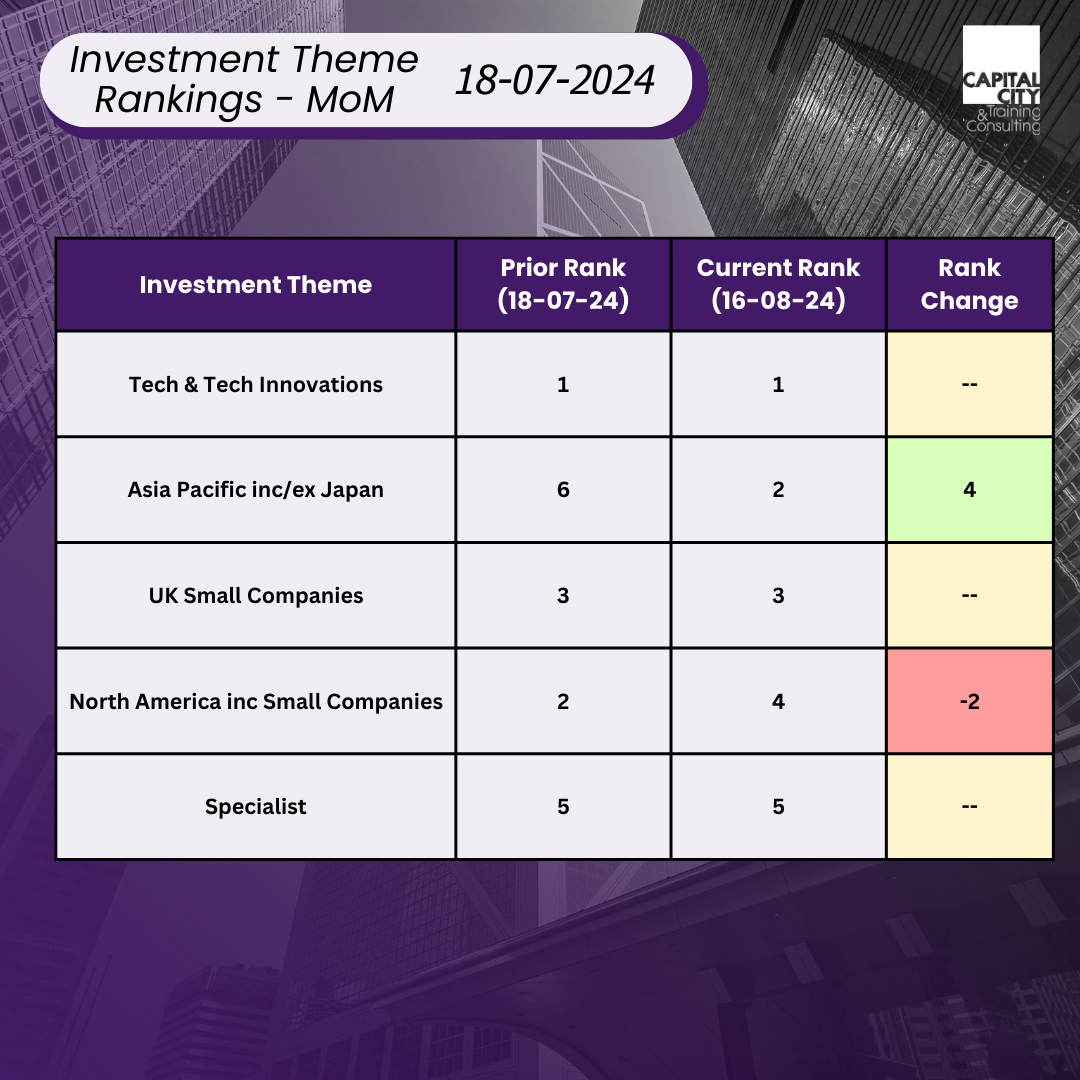

So, has the overall momentum picture changed much? Here are the top sector rankings:

The same stories continue – UK growth and small cos. Asia too and Tech- notwithstanding the 18th’s wobble- are still the top performers over 6 months, even if momentum in tech is now weakening slightly.

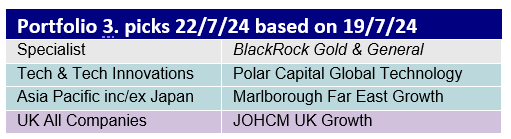

The new portfolio for July is as follows:

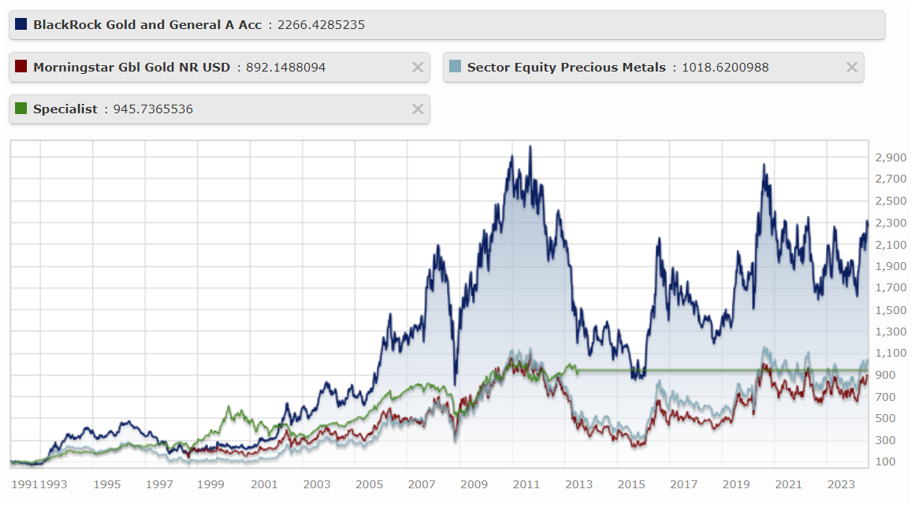

India has fallen down the rankings slightly to be replaced by Blackrock Gold and General.

Gold has been a very strong performer over the last three years attributed to a number of issues by the press: Central banks increasing gold reserves; the Chinese Central Bank in particular (in preparation for a Taiwan invasion and the end of dollar clearing?); concern amongst investors about fiat currencies and sovereign indebtedness; inflation hedging; war in the Ukraine and then Israel.

- Oct ’23 – https://www.ft.com/content/d78f31ea-b909-44d9-ac71-8ae1eb6ca977

- Oct ’23 – https://www.ft.com/content/abc39431-1755-4906-b11e-ee9e53baadfe

- Nov ’23 – https://www.ft.com/content/2d284a5d-3ec9-477c-b9c0-805f2e2fd6ec

- Apr ‘24 – https://www.ft.com/content/fa1b68ab-5b4e-4574-ba4e-224dcf9cc189

This period of underperformance seems to be coming to an end as M&A activity picks up in the sector with a number of deals so far in 2024. You can think of a gold miner as a gold price future – it will produce a stream of gold- but management may need a lot of cash to increase capacity and the sector has a history of “mistiming” investment. So, you may not get any cashflow. Ouch! This portfolio addition is a perfect illustration of the dangers of momentum investing: the performance of this fund has been very strong over the long term (like Gold), but the volatility has been eye-watering.

We can only hope that today we are in “October 2008” and not “September 2011”.