What is CAPEX and OPEX?

Capital expenditures (CAPEX) and operating expenses (OPEX) are two important items from a company’s cash flow and income statement (respectively). They are both key financial metrics that companies use to budget, forecast, and analyse their spending. Understanding the difference between CAPEX and OPEX is especially important for making sound investment decisions and properly allocating financial resources.

In corporate finance, CAPEX refers to the money a company spends to acquire, maintain, or improve fixed assets like property, buildings, technology, or equipment. OPEX refers to the ongoing costs a company incurs for running day-to-day operations. Analysing CAPEX and OPEX helps determine where a company is investing its capital and how efficiently it is operating.

Article Contents

Key Takeaways

| Topic | Key Takeaways |

|---|---|

| Definition of CAPEX | Capital expenditures made to acquire, upgrade long-term assets like property, equipment, technology. Considered an investment, not an expense. Capitalized on the balance sheet, depreciated over time. |

| Definition of OPEX | Operating expenses for day-to-day operations. Considered a cost, expensed immediately. Examples include salaries, rent, utilities, marketing. |

| Accounting Treatment | CAPEX is capitalized and depreciated over time. OPEX is expensed immediately. |

| Tax Deductibility | CAPEX depreciation is deductible over the asset’s life. OPEX is fully deductible when spent. |

| Analyzing in Excel | Download financial statements. Create columns for CAPEX and OPEX items. Calculate totals and metrics like % change. Use pivot tables, charts to analyze. |

| Importance of Metrics | Operating margin relies on OPEX. Return on capital relies on CAPEX. A balanced CAPEX and OPEX strategy enables growth. |

Capital Expenditures (CAPEX)

CAPEX refers to the capital expenditures a company makes to acquire, upgrade, or maintain physical assets such as:

- Property, buildings, facilities

- Machinery, tools, equipment

- Vehicles

- Technology, hardware, software

CAPEX investments are made to create benefit for the company over many years, not just in the current period. Examples include constructing a new factory, upgrading to new software systems, or replacing old equipment with newer models.

CAPEX is considered an investment for the future rather than an expense, as these investments will generate returns over the long-term. CAPEX spending is also known as capital spending or capital costs.

Operating Expenses (OPEX)

OPEX refers to the ongoing, regular expenses a company incurs from its day-to-day operations. OPEX spending is what a company requires to keep the lights on and doors open. Examples of OPEX include:

- Employee salaries, wages, benefits

- Rent, utilities, insurance

- Supplies and services

- Marketing, advertising, promotions

- Research and development

- Travel, vehicle costs

- Legal, accounting, other professional fees

Unlike CAPEX, OPEX spending is considered a cost and is expensed in the current period. OPEX is also known as operating costs or operational expenditures/expenses.

There is potentially overlap and some ambiguity in the definitions of the two items: OPEX will contain an expense for “Repair and renewal” (R&R). It may be advantageous to classify expenditure as R&R because this will be immediately deductible in full from taxable profit. CAPEX will only be offset against tax over a much longer period. In the UK, the tax authorities draw the line as follows: “if an asset is altered or improved, then it is CAPEX, it is not allowable expenditure” (for tax purposes), i.e. R&R.

For analysts, an important question when looking at CAPEX is to assess whether CAPEX is “maintenance” CAPEX, replacing old worn-out machinery to simply maintain capacity, or is it Investment CAPEX, giving rise to an increase in productive capacity.

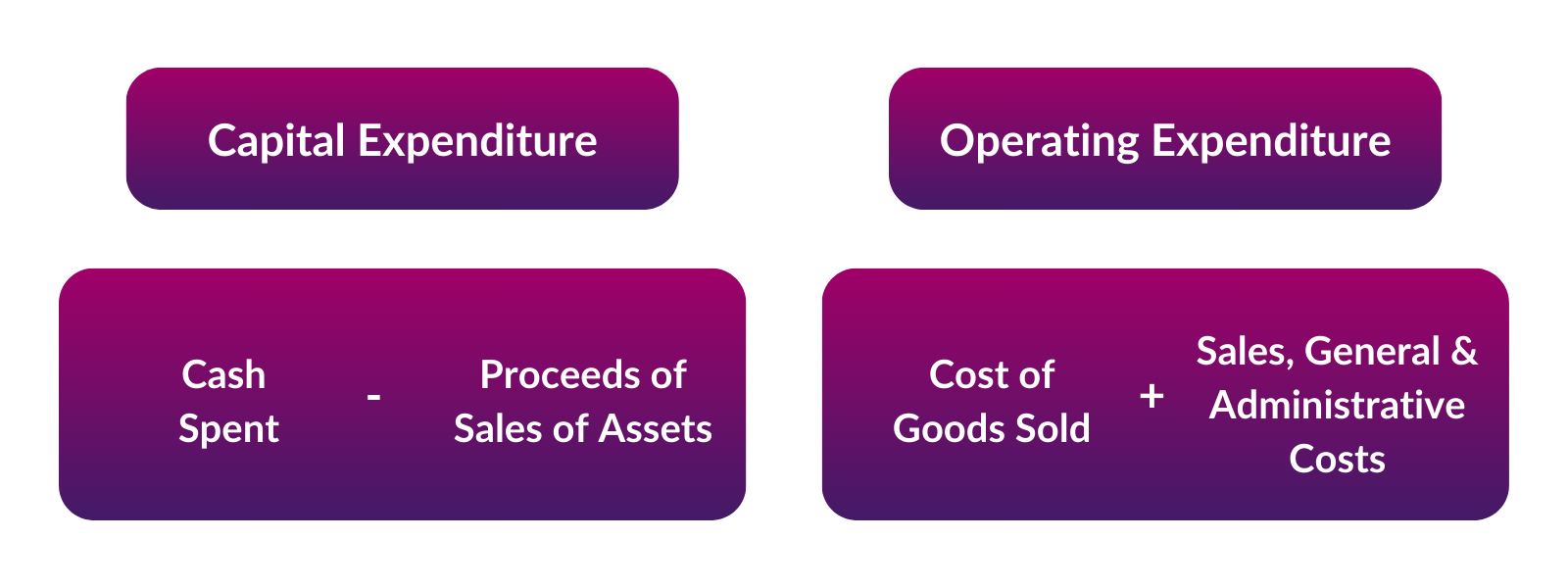

Formula for Calculating Capital Expenditure

Capital expenditures can be presented on a gross or net or gross basis in a set of accounts:

Net CAPEX = Cash spent – Proceeds of Sale of Assets

CAPEX spending is not deducted from the income statement in the year of purchase i.e. it is not “expensed”. Instead, the cost of the asset will be “depreciated” gradually through the income statement over the useful life of the asset. The aim is to match revenues and expenses over time: If a plane will fly for 25 years before it is retired from service, it makes sense to treat 1/25 of the capital cost of the plane as an expense in each year it is in service.

CAPEX does not necessarily tell us the full story about the investment in new capacity made by a company in a year. When a company enters a lease, there is not always any immediate cash impact. Instead, the value of the leased asset and a corresponding amount of lease debt appear on the asset and liability sides of the balance sheet. There is no “CAPEX”. A company may also buy other companies or make investments in joint venture or associates. These may all increase the productive assets under the control or partial control of the company.

Formula for Calculating Operating Expenses

The formula for calculating operating expenses is:

OPEX = Cost of Goods Sold + Sales General and Administrative Costs

Where:

- Cost of Goods Sold (CoGS) represents the costs directly incurred in production of the goods or services that the Company provides.

- Sales General and Administrative Costs is exactly what it says it is – the series of costs and expenses that aren’t directly involved in a business’s production process or service provision.

In a manufacturing company for example, it is very easy to categorise a lot of costs:

- Raw materials are clearly a cost of goods

- Wages will need to be split according to the functional role of the staff member – do you work on the factory floor (CoGS), or in management or an office (SG&A)?

- Depreciation will be split across CoGS and SG&A again depending on what the asset is. Is it a production machine or an office building?

An operating expense is not necessarily recorded in the period when it is paid for in cash.

Using the same “matching principle” mentioned above, we will match revenues and expenses in time. Taking a simple example like insurance:

- Suppose a company pays its Annual property insurance premium in June. The company’s year-end is December.

- In this case, only half of the cost of the insurance would be expensed in the year.

- The “unused” half of the insurance policy would be recorded as a “prepayment” asset on the balance sheet i.e. the company treats the outstanding half of the policy as an asset.

- There is a “future benefit” – this is the definition of an asset – to be had from the remaining half of the policy. This will become an expense the following year as the company reaps the remaining benefit of being insured.

OPEX is fully deducted in the year it was spent. It is not amortized over time like CAPEX.

CAPEX vs OPEX: Accounting Implications and Tax Considerations

CAPEX and OPEX have different accounting and tax implications:

Accounting Treatment

CAPEX is capitalized on the balance sheet. It is recorded as a long-term asset that is depreciated over multiple accounting periods.

OPEX is the proportion of direct and indirect production cost expensed on the income statement in a period. It is recorded as a cost against revenues.

Tax Deductibility

CAPEX deductions are spread over the useful life of the asset. Only the annual depreciation can be deducted each year.

OPEX is fully tax deductible in the period it was spent.

For accounting purposes, CAPEX improves a company’s balance sheet position but hurts the income statement in the near term due to depreciation expenses. OPEX negatively impacts the income statement but does not create a depreciable asset.

For taxes, CAPEX provides deductions over many years while OPEX provides an immediate deduction. Companies can use a mix of CAPEX and OPEX to optimize their tax position.

Typically, to incentivize investment by companies, Tax authorities give accelerated capital allowances. What this means is that whilst a company may depreciate an asset over 8 years, expensing 12.5% of original cost per year, the Tax authorities may allow a bigger deduction for calculating tax. This lowers the tax bill. In the UK, in this case a 25% deduction would be allowed in year one and then an 18.75% deduction in year 2 and a 14.1% deduction in year 3. This reduces the overall tax burden for the first three and a half years after investment.

Analysing CAPEX and OPEX in Excel

CAPEX and OPEX spending can be analysed in Excel to track where a company is allocating resources:

- Download a company’s income statement and balance sheet. These will contain CAPEX and OPEX figures.

- In Excel, create separate columns for the major CAPEX and OPEX line items from the financial statements.

- For each major CAPEX line, enter the cash spent and annual depreciation. Calculate CAPEX spending as Cash Spent – Depreciation.

- For each OPEX line, enter the cash spent as this equals the total OPEX.

- Use Excel formulas to sum the CAPEX and OPEX amounts for different periods and categories.

- Create charts and graphs in Excel visually comparing CAPEX vs OPEX over time.

- Add columns with % change from year to year and contribution to total spending.

- Use pivot tables to easily sort and filter CAPEX and OPEX data as needed.

This Excel analysis can identify spending patterns and trends to see where resources are being allocated. The mix of CAPEX vs OPEX can be compared to peers.

Some key places where you will examine CAPEX and OPEX metrics in corporate finance include:

- A company’s operating margin = (Sales-OPEX)/Sales – this is a key measure of the relative strength of a company’s competitive strength.

- Return on capital employed = (Sales-OPEX)/(Fixed assets + Net operating assets) – this is a crucial measure of the quality of earnings of a company. The higher the RoCE of a company, the more successful its operating model is. Value investors use this as a key metric to assess the quality of a business.

- As a general rule, companies have to make CAPEX in order to grow. A company that does not renew and improve its capital base through CAPEX will probably lose competitiveness over time.

Case Studies for Analysis of CAPEX and OPEX

Major Tech Company – CAPEX for Growth

A major tech company has been aggressively increasing CAPEX expenditures in recent years to build new data centres, cloud infrastructure, and capabilities. This has lowered near-term earnings due to higher depreciation expenses. However, the tech company’s market share has significantly grown thanks to these investments. This is an example of a growth strategy fuelled by prudent CAPEX spending.

Mature Manufacturer – OPEX Efficiencies

A mature manufacturer has kept CAPEX spending relatively flat in recent years as its assets and capabilities remained adequate. It focused more on reducing OPEX by streamlining operations, cutting excess costs, and improving productivity. This helped improve profit margins through OPEX efficiencies rather than asset investments.

Young Startup – Balanced Allocation

A young startup has been careful to allocate capital raised between essential CAPEX for technology, equipment, and office space while keeping OPEX like marketing and hiring controlled. As the startup matures, CAPEX investments continue enabling growth. The balanced allocation has helped the startup scale efficiently.

Analysing the CAPEX and OPEX strategies in these case studies provides examples of how expenditure optimization promotes long-term success.