Types of Assets in Finance

In the world of finance and accounting, assets play a crucial role in determining the financial health and value of an organisation.

Assets are the resources controlled by a company and they are usually 100% owned but need not be! There are many different categories of assets – ranging from tangible items like property, machinery and equipment, to intangible assets such as intellectual property and goodwill. Understanding the different types of assets is essential for effective financial analysis, investment decisions, and accurate reporting. This article delves into the various categories of assets, their classification, and their importance in the realms of finance and accounting.

Assets are fundamental components of a company’s balance sheet, and they can only be shown on the balance sheet to the extent that those resources are expected to contribute some future economic benefit to the company. Eg inventory that can be sold, machinery that will manufacture goods to sell. Without the assets the company cannot generate future economic benefit – profit!

These resources can take many forms, from physical assets like machinery and inventory to financial instruments like stocks and bonds, and even non-physical assets like software, patents and licences.

Article Contents

- What are the main types of Assets?

- Current Assets

- Non-Current Assets

- Asset Classification for analysis

- Why are assets important?

- Asset Acquisition and Disposal

- Accounting treatment of Disposals

- Asset Financing

- Asset Valuation Methods

- Impairment of Assets

- Interpreting Assets in Accounting and Finance

Key Takeaways

| Key Takeaway | Description |

| Asset Categories | Assets are broadly categorized into Current Assets (short-term, convertible within 1 year) and Non-Current/Fixed Assets (long-term) |

| Current Assets | Include cash, accounts receivable, inventory, and prepaid expenses |

| Non-Current Assets | Include property, plant & equipment (PP&E), intangible assets, investments, joint ventures/associates, and deferred tax assets |

| Asset Classification | Assets can be further classified based on convertibility (liquid vs. non-liquid), physical existence (tangible vs. intangible), and usage (operating vs. investment) |

| Importance of Assets | Assets generate revenue, serve as collateral for financing, demonstrate financial strength, facilitate operational efficiency, and build long-term value |

| Asset Acquisition | Assets can be acquired through purchase, lease, construction, or exchange |

| Asset Disposal | Assets can be disposed of through sale, retirement/abandonment, or exchange, resulting in a gain or loss on disposal |

| Asset Financing | Assets can be financed through debt, equity, leasing, or asset-based lending |

| Asset Valuation Methods | Common valuation methods include historical cost, fair market value, replacement cost, and net realizable value |

| Impairment | Assets may need to be written down (impaired) if their value declines significantly or they become unable to generate future economic benefits |

What are the main types of Assets?

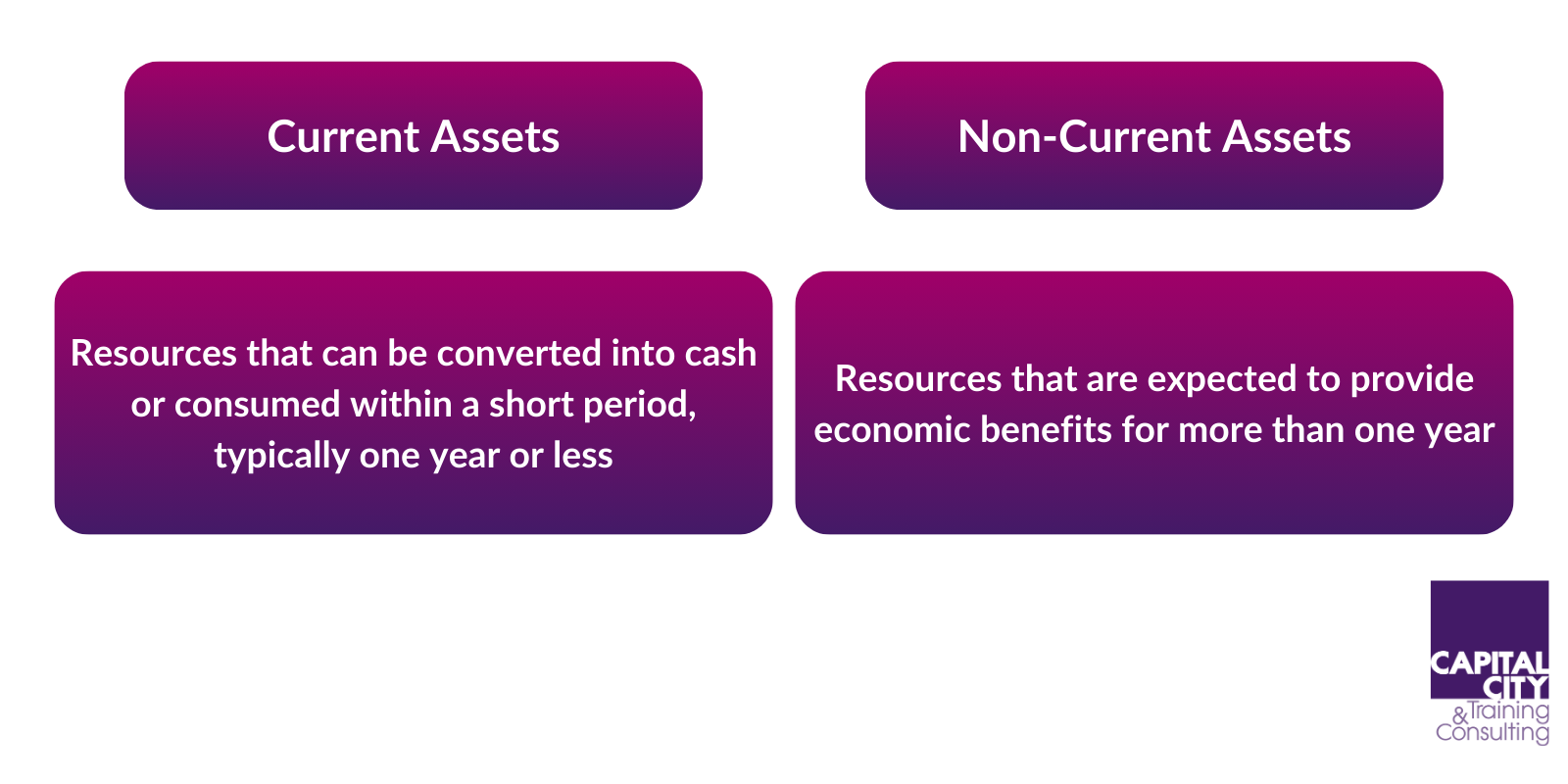

Assets are presented on a balance sheet under 2 broad categories: Current Assets and Non-Current assets.

Current Assets

Current assets are resources that can be converted into cash or consumed within a short period, typically one year or less. These assets are vital for maintaining the day-to-day operations of a business. Examples of current assets include:

- Cash and ‘Cash Equivalents’: This includes physical currency, checking and savings accounts, and short-term investments that can be easily converted into cash.

- Accounts Receivable: These are amounts owed to the company by customers for goods or services provided on credit. So they will be cash pretty soon!

- Inventory: This includes raw materials, work-in-progress, and finished goods that a company holds for sale or production. They are included in the balance sheet at historic cost (i.e. the cost of getting the inventory to its current location and condition). That could be the cost of manufacturing, or simply the cost of buying wholesale finished goods from suppliers.

- Prepaid Expenses: These are payments made in advance for future expenses, such as rent, insurance, or subscriptions. Note: the benefit to be received by the company is in the future and so it is classified as an asset where there is ‘expected future economic benefit’.

Non-current Assets

Non-current assets, also known as long-term or fixed assets, are resources that are expected to provide economic benefits for more than one year. These assets are typically more permanent and are used to support the long-term operations of a business. Examples of non-current assets include:

- Property, plant, and equipment (PP&E): This includes land, buildings, machinery, vehicles, and other physical assets used in the production or delivery of goods and services. It includes head office assets, not just those directly involved in production.

- Intangible assets: These are non-physical assets that have economic value, such as patents, trademarks, copyrights, and goodwill.

- Investments: This category includes long-term investments in stocks, bonds, real estate, and other financial instruments.

- Joint Ventures and Associate companies: these occur where the company owns a significant portion of equity in another company (but not a controlling stake of more than 50%). They are shown separately to smaller equity investments due to the significant influence the company will hold over these companies. The accounting treatment is different to regular ‘cost accounting’ too.

- Deferred Tax Assets: These are temporary differences between the tax and accounting treatment of certain items that are expected to result in future tax deductions (but always due to some historic transaction – it’s not a forecast!)

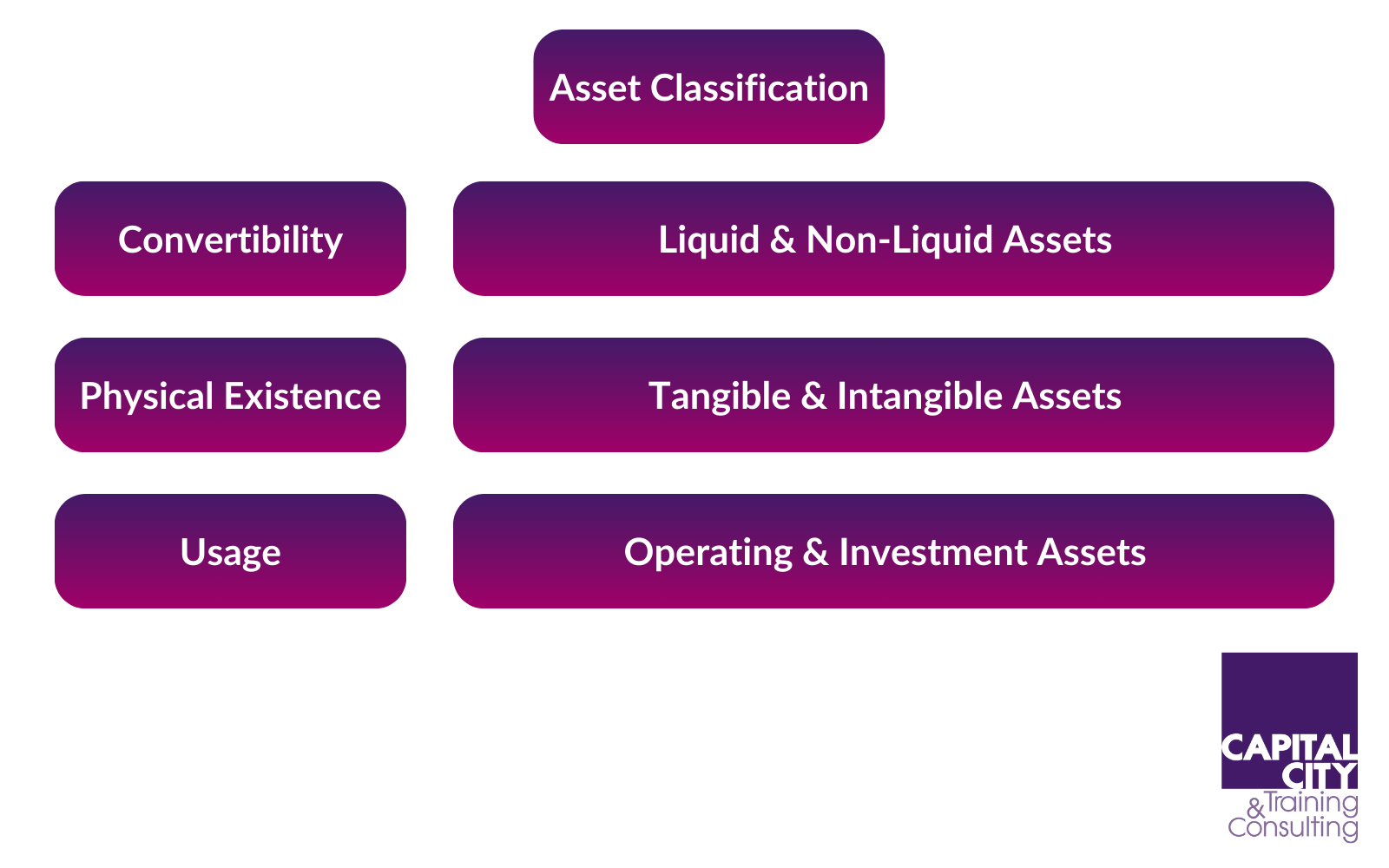

Asset Classification for Analysis

To make good use of the numbers, analysts will typically further classify assets based on various criteria, including their convertibility, physical existence, and usage.

Convertibility

Assets can be classified based on their ease of conversion into cash or other liquid assets:

- Liquid assets: These are assets that can be easily converted into cash with minimal loss in value. Examples include cash, marketable (tradeable) securities, and short-term investments.

- Non-liquid assets: These are assets that are difficult to convert into cash or may result in a significant loss of value during conversion. Examples include real estate, equipment, and intangible assets.

Physical Existence

Assets can also be classified:

- Tangible assets: These are physical assets that have a material form and can be touched or seen. Examples include cash, inventory, equipment, and real estate.

- Intangible assets: These are non-physical assets that lack a material form but still have economic value. Examples include patents, copyrights, trademarks, and goodwill. Note that generally only purchased intangibles can be shown as assets on the balance sheet and not self-generated ones. One common exception to this is the cost of creating proprietary software for use in the business. The costs can be capitalised into Intangible assets and amortised (spread) through the P&L over its estimated useful life.

In credit analysis and banking, it is common to identify and use the “Tangible Net Worth” of a company which excludes all intangible fixed assets in its calculation – to be more conservative and to make a better estimate of the company’s assets available for securing loans. Tangible is safer!

Usage

Assets can be further categorised based on their usage or purpose within the business:

- Operating Assets: These are assets that are used in the day-to-day operations of the business to generate revenue. Examples include machinery, equipment, and vehicles. The Operating Assets are the ones that contribute to the generation of EBIT (operating profit).

- Investment, or Financial, Assets: These are assets that are held for the purpose of generating income or capital appreciation over time. Examples include equities, bonds, and real estate investments (including JVs and Associate companies). Financial assets do not contribute to EBIT – they just generate Finance Income (or losses!) in the P&L which is excluded from operating profit.

Why are Assets Important?

Assets play a vital role in the financial health and success of an organisation. Here are some key reasons why assets are important:

- Generating revenue: Assets such as machinery, equipment, and intellectual property are essential for producing goods or providing services, which ultimately generate revenue for the business. The assets need to be maintained and invested in to ensure future profit generation. If the asset number on the balance sheet is declining, then it is a sign of underinvesting – and that could damage future profitability.

- Collateral for financing: Tangible assets can be readily used as collateral to secure loans or other forms of financing, enabling businesses to access capital for growth and expansion. This is why it is useful to have Tangible assets identified – and that’s why banks like to look at tangible net worth.

- Demonstrating financial strength: A strong asset base can indicate a company’s financial stability and creditworthiness, which can be attractive to investors and lenders.

- Facilitating operational efficiency: Investing in assets like advanced technology or modern facilities can improve operational efficiency, reducing costs and increasing profitability.

- Building long-term value: Certain assets, such as real estate or intellectual property, can appreciate in value over time, contributing to the long-term growth and wealth of the organisation. But note – Fixed assets are rarely shown at value: the basic convention you should assume is that they are measured at Historic Cost. Financial assets (equities) are one of those exceptions that should be measured at market value.

Asset Acquisition and Disposal

Asset acquisition is the process of obtaining ownership or control over resources that provide future economic benefits to an organisation. There are several methods of acquiring assets, including:

- Purchase: This is the most common method, where an asset is acquired by directly buying it from a seller, often involving a cash transaction or financing arrangement.

- Lease: Rather than purchasing an asset outright, a company can enter into a lease agreement, which grants the right to use the asset for a specified period in exchange for periodic rental payments. Note that these assets are still shown on the balance sheet in pretty much every case when applying IFRS. Our accounting e-learning explains more on this.

- Construction: Certain assets, such as buildings or specialised equipment, may be constructed or assembled by the company itself or through a contracted third party.

- Exchange: In some cases, assets can be acquired by exchanging or trading other assets or equity interests.

Regarding asset disposal, there are also various methods, including:

- Sale: An asset can be sold to another party, typically for cash or other consideration.

- Retirement or Abandonment: If an asset is no longer useful or has reached the end of its useful life, it may be retired or abandoned, often resulting in a loss or gain on disposal.

- Exchange: Similar to acquisition, assets can be disposed of by exchanging them for other assets or equity interests.

Accounting treatment of Disposals

When a fixed asset is sold and the transaction recorded, a profit or loss ‘on disposal’ will appear in the P&L. This is not the revenue less original cost. The asset will have already been depreciated through the P&L during its life at the company, so it’s remaining Net Book Value (original cost less accumulated depreciation) will be lower than original cost.

The profit on disposal is calculated as:

- Proceeds from disposal (fair value, if not cash) Less the Net Book Value

This this profit or loss is typically treated by analysts as a non-core item of income in the P&L. It is still part of Operating Profit, but not a predicable ‘core’ part.

Any cash received on disposal will be treated as an Investing Activity inflow in the Cash Flow Statement.

Asset Financing

Acquiring assets often requires significant capital investment, and companies may choose to finance these purchases through various means:

- Debt Financing: This involves borrowing funds from lenders, such as banks or bondholders, to finance asset acquisitions. The debt is typically secured by the asset itself or other collateral, and the company is obligated to make periodic interest and principal payments.

- Equity Financing: Companies can raise funds by issuing additional shares of stock, either through public offerings or private placements. The funds raised can be used to acquire assets but will dilute existing shareholders’ ownership interests unless they contribute more equity toward the acquisition too.

- Lease Financing: Rather than purchasing an asset outright, a company can enter into a lease agreement with a lessor, who retains ownership of the asset. The company makes periodic lease payments, effectively financing the use of the asset over its useful life.

- Asset-Based Lending: In this form of financing, a company uses its existing assets as collateral to secure a loan or line of credit, which can then be used to acquire additional assets.

The choice of financing method depends on factors such as the company’s existing capital structure, the cost of financing, tax implications, and the specific assets being acquired. Effective asset financing strategies can help companies acquire the necessary resources while managing risks and maintaining financial flexibility.

Asset Valuation Methods

Asset valuation is a critical aspect of financial reporting and decision-making, as it determines the value at which an asset is recorded on the balance sheet. There are several methods used to value assets, each with its own strengths and weaknesses:

- Historical Cost: This method values an asset at its original purchase price or construction cost, including any additional costs incurred to make the asset operational. It is widely used due to its objectivity and verifiability – generally, accountants don’t like things that are hard to measure! Historic cost will include all costs for getting the machinery installed and running.

- Fair Market Value: This method estimates the price that an asset would fetch in an open market between willing buyers and sellers. It is commonly used for certain financial assets, such as investment in equity shares, but it is possible to also ‘revalue’ property to market value – although it is not common. Note that if the company is a real-estate investment company, then the property MUST be measured at fair market value – which can be pretty volatile and will involve independent verification from time to time.

- Replacement Cost: Not used in official financial statements, but useful in management accounts, this method values an asset based on the current cost to replace it with an identical or substantially similar asset, taking into account any technological advancements or changes in market conditions.

- Net Realisable Value: For assets held for sale, such as inventory or certain investments, this method values the asset at the expected selling price less any additional costs required to complete the sale. Inventory has to be included in the accounts at the lower of cost and Net Realisable Value, to be conservative.

The choice of valuation method depends on various factors, including the nature of the asset (is it an investment?), the purpose of the valuation, and most importantly, the applicable accounting standards. Historic Cost is the most common.

Impairment of Assets

If any asset is believed to be held in the balance sheet at a number greater than its ‘recoverable amount’ to the business, then the management must make a one-off extra charge against that asset to bring it down to its new value. That extra charge is an impairment charge. The dual impact on the accounts is:

- Asset value is reduced by the impairment amount

- Expense to the P&L – ‘impairment charge’

The recoverable amount is the higher of its Net Realisable Value and its Value in Use. What is Value in Use? It is essentially the present value of future returns that the equipment or machinery is helping generate.

Interpreting Assets in Accounting and Finance

In the context of accounting and finance, assets play a crucial role in financial reporting and decision-making. Here are some important considerations related to assets:

- Asset valuation: Assets are recorded on the balance sheet at their historical cost or fair market value, depending on the accounting standards and principles followed by the organisation.

- Depreciation and Amortisation: Certain assets, such as equipment and intangible assets, are subject to depreciation (for tangibles) or amortisation (for intangibles), which involves allocating their cost over their estimated useful life. This estimate is at the company’s discretion based on realistic assumptions and experience. But it’s worth noting that by extending the useful life of an asset, companies can boost their profits by taking a lower depreciation charge to the P&L. Look out for companies that keep changing estimated useful lives – it’s a red flag!

- Asset Impairment: If an asset’s value declines significantly or becomes impaired, it may need to be written down or recorded at a lower value on the balance sheet.

- Asset Management: Effective asset management involves monitoring, maintaining, and optimising the use of assets to maximise their value and return on investment.

- Asset Disposal: When an asset is sold, retired, or otherwise disposed of, the transaction is recorded, and any resulting gain or loss is recognised in the financial statements.

In conclusion, assets are fundamental components of any organisation’s financial structure. Understanding the different types of assets, their classification, and their importance is crucial for effective financial management, decision-making, and accurate reporting. By carefully managing and optimising their asset portfolio, businesses can enhance their operational efficiency, financial stability, and long-term growth prospects.