New Year, New Tariffs – 31-01-25 – MMT Analysis

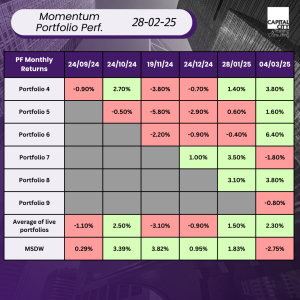

This is the ninth month of running our momentum portfolios and performance has been mixed again. Finally though, our momentum experimental portfolios have all beaten the index!

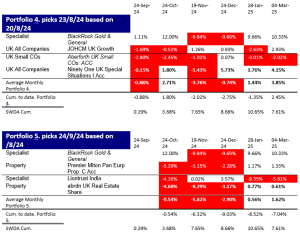

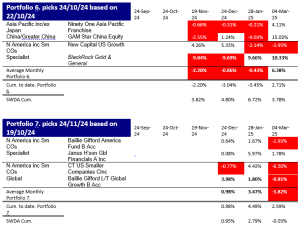

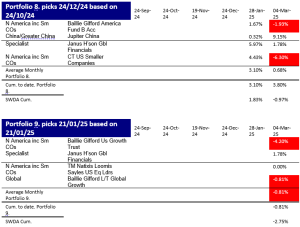

What are the factors driving the performance? Here are the individual portfolios:

All portfolios have finally outperformed the index. Why? Because they all are less US and tech biased. Beating this index means the US and tech underperform. Both have demonstrably done the opposite for a long time. The US is 2/3 of the SWDA index.

US Valuations

The dilemma for investors today is can US high valuations continue? The US market’s place in global equities is disproportionate: The U.S. stock market is two-thirds of global market value, but America represents only one-quarter of the world’s economy and 4% of the world’s population.

Valuations multiples for the tech stocks are at record levels. If our strategy is only to beat the index, then perhaps there is no alternative but to be 50% to 2/3 US weighted. If we want to make absolute returns, then perhaps a strategy of focusing on value may be more relevant? If we look at how markets have performed so far this year, we can see two interesting developments: firstly, increased dispersion of returns – the Magnificent 7 are not performing uniformly, with Tesla and Alphabet down but Meta up. This is part of a broader picture in the US.

Election Consequences

Whilst the Trump presidency and uncertainty over tariffs is causing concern, markets are not suffering. Some individual stocks are volatile, but US volatility is falling.

The impact of Trump’s foreign policy, the prospect of peace in Ukraine. the unwinding of the “Trump trade,” and the impact of the Deepseek AI has been to give a boost to cheaper value markets and indices, like the FSTE100. European stocks generally have performed well so far in 2025.

Momentum in February and a new Tenth Portfolio

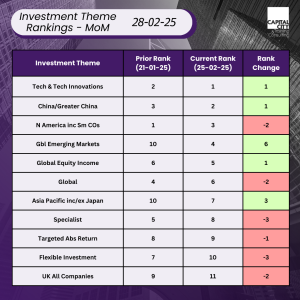

So, has the overall momentum picture changed much? Here are the top sector rankings: Tech and tech innovation have been promoted, even though short-term performance is negative. Correlation with many of the other major themes means that tech is still looking relatively strong over 6 months, even if its trend has weakened. China in contrast with increasingly business friendly signals from Xi Jinping and with the impetus given to Chinese tech by Deepseek means that the best Chinese funds have now had a better absolute performance over the last 6 months, in some cases rising nearly 50%.

As well as China driving performance in the latest funds, Gold is the other continuing performer.

This month, rather than taking a pure momentum approach, I will use some judgement to see if we can improve performance. I am now going to use 4-week momentum to choose funds, and I am specifically going to underweight, i.e. ignore the US and tech on the basis that their momentum is now negative, even if that is not fully reflected in the 6-month momentum figures.