President Elect Trump and the US Dominate the Month – MMT Analysis – 21-11-24

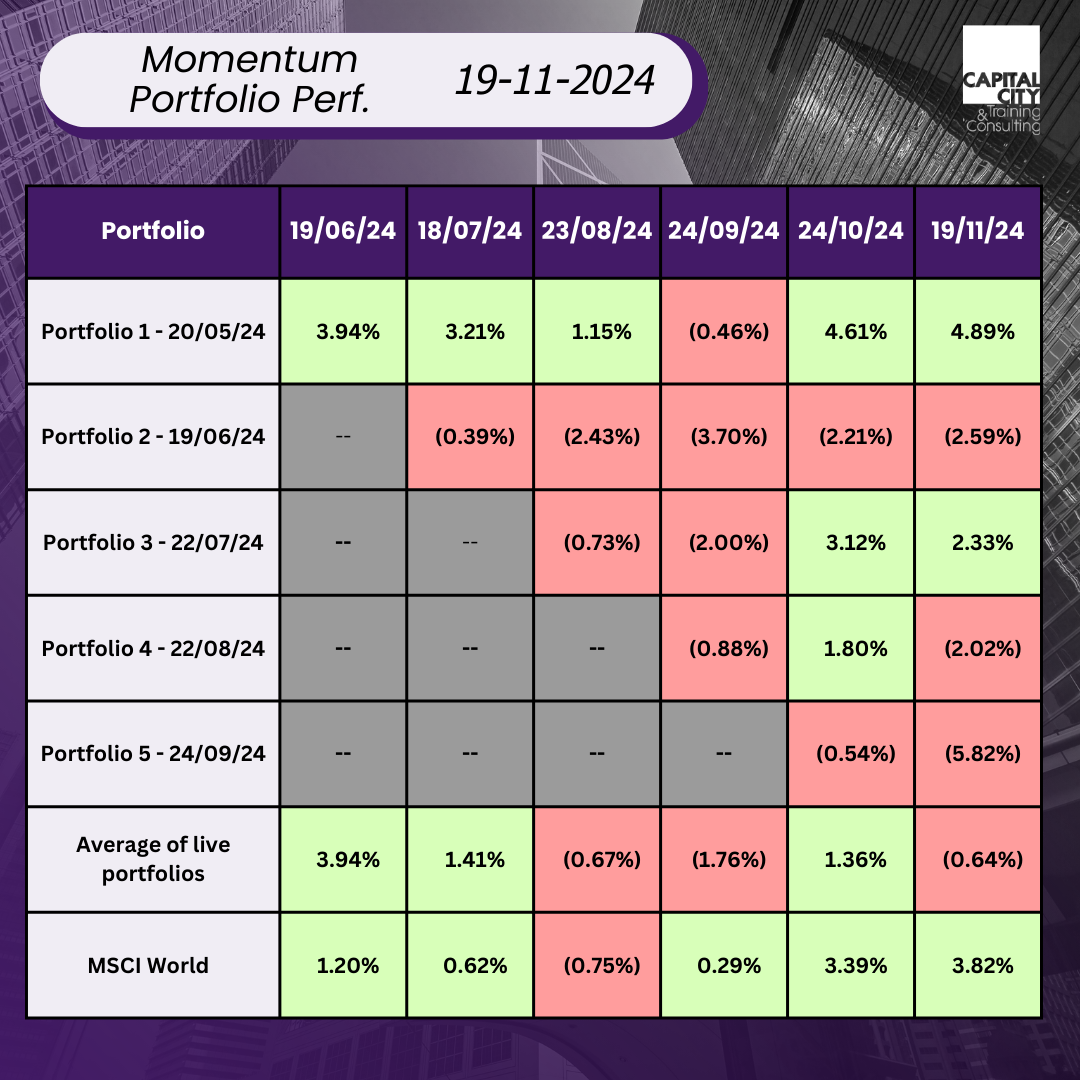

This is the sixth month of running our momentum portfolios and performance has been mixed again:

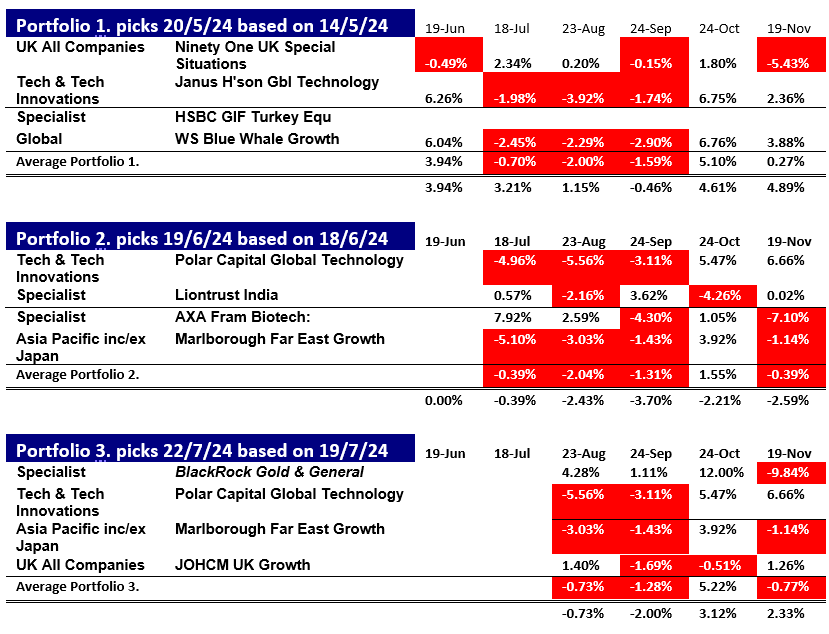

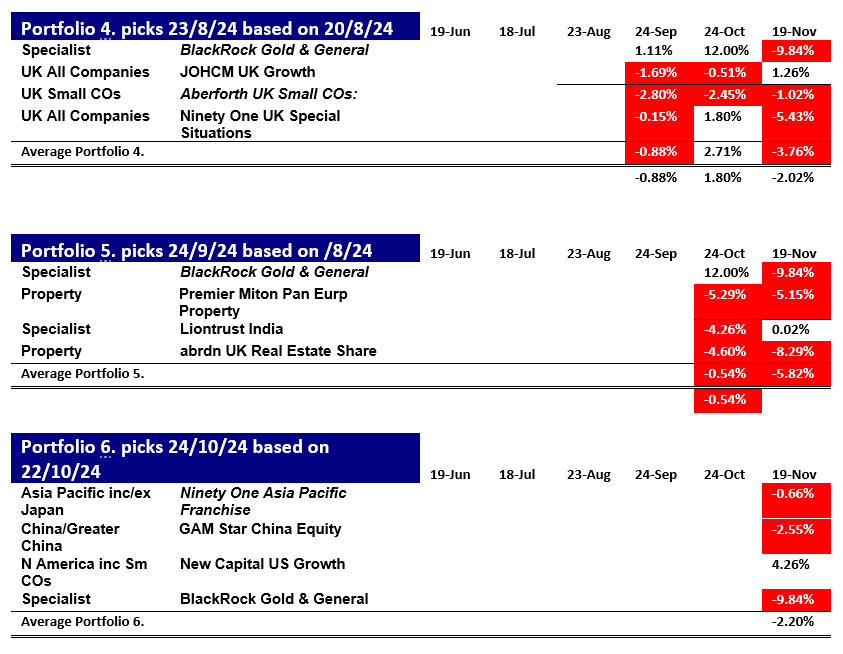

What are the factors driving the performance? Here are the portfolios:

Last month we had a range of different drivers. In November we had only one, the election of Donald Trump. What is startling is the dispersion of returns in the month. President-elect Trump’s policy platform will give clear winners and losers – in the eyes of the market at least. Indeed, whether strongly up or strongly down, all the asset returns are driven by the election result.

US Election – Stocks

Trump’s plans around loosening regulations, tariffs and tax cuts have been hugely positive for US stocks, both large and particularly small and mid-cap.

There is one notable exception – big pharma, which is expected to come under attack from Health secretary Kennedy.

Commentators have continued to write about the risk of a US recession, but labour data imply a strong economy. This high-profile data is echoed in consumer loan default statistics, so, default data is neutral/positive, and debt investors are positive too about the state of the economy.

US Election – Currency

The Dollar’s rally continues too and depresses gold as investors sweep money back into risk assets, but also like Sterling and the Euro, gold has fallen against the dollar. Whilst UK interest rates look set to remain high, the ECB is likely to cut, widening interest rate differentials with the dollar.

Changes in the UK and EU

Leaving the US aside, two markets have momentum of their own, the UK and the EU. Unfortunately, not for the good. The UK is beset by the very negative sentiment about Government tax increases and their impact on inflation. UK inflation has ticked up in the month, markets slightly down, btu property, falling. The EU as well as having political instability in Germany – the government coalition has collapsed and a faltering economy, it also has instability in France, where the Prime Minister, M. Barnier is very unpopular. The prospect of US trade tariffs on EU goods has been very bad for European market – the CAC100 in France is down over 3% on the month.

Momentum in November and a new sixth portfolio

So, has the overall momentum picture changed much? Here are the top sector rankings:

Last month’s picture has changed a lot: China’s dramatic month has lifted it to number one and the Asia Pacific funds group with it. Property has had a big bout of profit taking so even though its position has stayed at 5, returns have been negative on the month.

Specialist’s ranking at 5 hides the very strong performance of Gold and gold related stocks. Specialist covers a range of more esoteric strategies, but gold and gold mining funds, like Blackrock Gold and General are up almost uniformly over the last month. Interestingly retail investors seem to be selling gold, while central banks continue to buy.

UK equity income and UK small companies continue to fall back. The new Government’s honeymoon lasted only days. The outlook for taxes and anti-business policy looks far worse than anyone imagined. Falling interest rates and now falling inflation haven’t turned sentiment.

US performance in the month dominates everything. Technology and global funds both are highly US centric. Returns are so negative in the month that returns on many equity sectors have been pushed below bond returns over the 6-month horizon. A lot of equity performance outside the US has been wiped out. It will be interesting to see what if anything recovers: India is largely unscathed, and gold is beginning to recover to, a secular trend in gold prices perhaps reasserting itself.

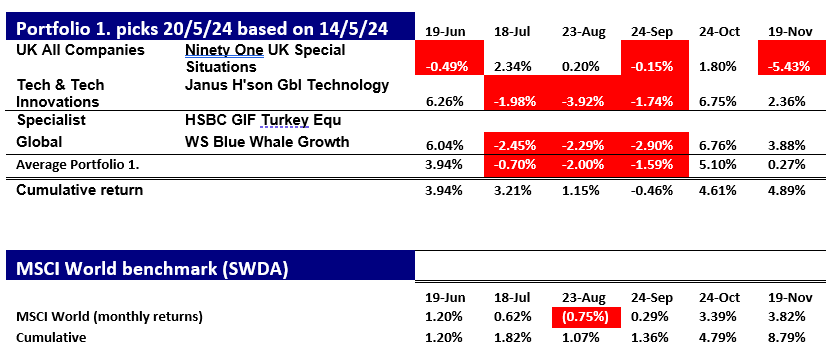

Our first portfolio matures. Have we beaten the MSCI world index (SWDA)?

Whilst having made a respectable return over its six-month life, our portfolio has been brought down by poor UK market performance. Whilst its exposure to the US is similar to SWDA, the UK has underperformed the global component of SWDA.

This is likely to be a continuing theme as we review the performance of the subsequent portfolios as they “mature.”