Net Cash Flow: Definitions, Formula and Examples

You must have heard the adage that circulates the world of finance…… Cash is King! Of course, the follow-on tag is “…. but Tax is Emperor!”, but let’s not go there. What analysts love about cash, is that cash is cash is cash. You can’t change what cash is, so cash flow is one of the least manipulated indicators of a business’s health. However, there are many ‘levels’ of cash flow and different categories that indicate corporate performance, efficiency and even financial stress.

Understanding the flow of cash within a business is a fundamental block in understanding its financial performance. This article delves into the intricacies of net cash flow, exploring its definitions, formulas, and applications, empowering readers to grasp its significance in the financial world.

Article Contents

Key Takeaways

| Topic | Key Takeaways |

| Definition of Net Cash Flow | The net amount of cash a business generates or consumes through all three standard cash flow categories: operating, investing, and financing activities. |

| Formula | Net Cash Flow = Cash Flow from Operating Activities + Cash Flow from Investing Activities + Cash Flow from Financing Activities |

| Importance | Indicates a company’s liquidity and ability to meet financial obligations; less manipulated than other financial indicators; critical for business survival and growth. |

| Components |

|

| Net Income vs Net Cash Flow | Net income reflects profitability (P&L), while net cash flow focuses on actual cash movements. Differences arise due to accrual accounting, credit sales, and non-cash expenses like depreciation. |

| Interpretation | Positive NCF is generally favorable, indicating sufficient liquidity. Negative NCF is a potential cause for concern if persistent. Consistency and allocation across activities are important to analyze. |

| Limitations | Does not account for non-cash transactions; potential for short-term accounting manipulation; provides a snapshot, may not reflect long-term health. |

| Complementary Metrics | Free Cash Flow, Cash Conversion Cycle, Cash Flow Statements |

| Importance for Business | Reflects liquidity, ability to service debt, fund growth, and ensure long-term sustainability. |

What is Net Cash Flow?

Although it seems simple, ‘what is Net Cash Flow?’ may actually pose more questions than it answers. Net of what? Which cash flow – just operating? Or net of investing cash flows? What about financing? You should never be shy of asking ‘which category of cash flow?’

But to start, if asked to measure Net cash flow, often referred to as NCF, it would normally be ALL cash inflows net of ALL cash outflows within a specified period, typically a financial year. So it is the net amount of cash a business generates or consumes through all three of the standard cash flow categories – operating, investing and financing activities.

The concept of net cash flow is rooted in the fundamental principle that cash is the lifeblood of any business. While profitability is essential, a company’s ability to generate positive cash flow is equally, if not more, crucial for its survival and growth. Profitable companies can have cash strain – especially if small and investing heavily in growing. A positive net cash flow indicates that a business has sufficient liquidity to meet its financial obligations, invest in growth opportunities, and reward its stakeholders. The bigger question is whether the cash flow is sustainable.

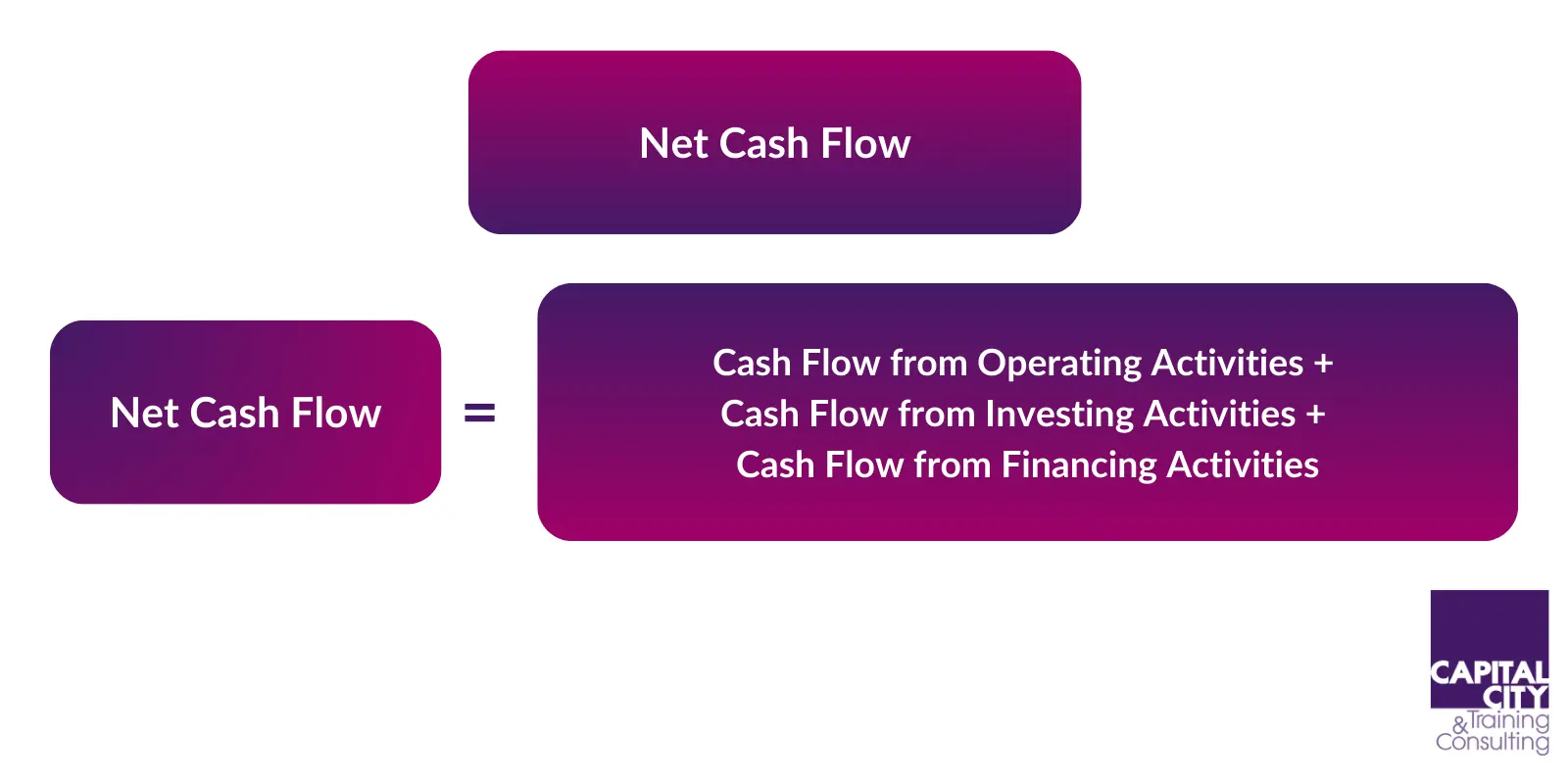

Formula for Calculating Net Cash Flow

The formula for calculating net cash flow is as follows:

Net Cash Flow = Cash Flow from Operating Activities + Cash Flow from Investing Activities + Cash Flow from Financing Activities

Cash Flow from Operating Activities: This component represents the cash generated or consumed by a company’s core business operations, such as sales, purchases, and operational expenses. This is the real lifeblood of a company, and if this is not positive then you have to start questioning the business model and whether things will turn around.

Cash Flow from Investing Activities: This component encompasses cash inflows and outflows related to investments, such as the purchase or sale of fixed assets, acquisitions, or the sale of investment securities. Healthy companies will be investing regularly in fixed assets, and growing companies may have significant commitments to achieve their goals. Without appropriate financing in place, this is where the strain can come. Investing activities will often be negative for healthy companies – and the question is whether they generate positive operating cash flows to fund this, or whether they have borrowed (see Financing cash flows).

Cash Flow from Financing Activities: This component includes cash movements resulting from financing activities, such as issuing or repurchasing shares, obtaining or repaying loans, and paying dividends.

By summing these three components, businesses can determine their overall net cash flow, providing a comprehensive view of their cash position.

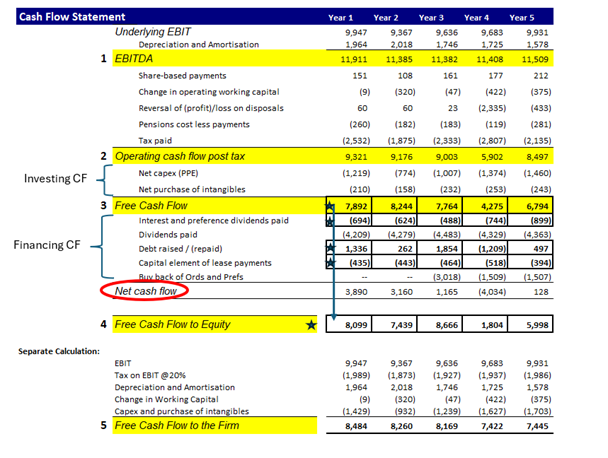

Here is a good little overview we’ve put together to show the different levels of cash flow presented in a typical Cash Flow Statement: it clearly shows EBITDA, Operating Cash Flow, ‘Free Cash Flow’ and Net Cash Flow so you can see the differences.

Net Income vs Net Cash Flow

It is essential to differentiate between net income and net cash flow, as they represent distinct aspects of a company’s financial performance. Net income, calculated on the income statement (P&L), reflects a company’s profitability by subtracting expenses from revenues. However, it does not necessarily reflect the actual cash movements within the business. The primary reason for this is the use of the ‘matching principle’ on which the P&L is built. The P&L will show income ‘earned’ rather than cash received. So, for example, if a company makes a sale on credit and is slow to collect cash from its credit sales, cash flow can be negative (plenty of P&L revenue earned, but not so much cash received!)

Net cash flow, in other words, focuses solely on the inflows and outflows of cash, providing a more accurate representation of a company’s liquidity and ability to meet its financial obligations. Another reason for profit and cash to differ significantly is depreciation of fixed assets. When companies invest in fixed assets, the cost is allocated to the P&L over its useful life to the business. This could be, say, 10 years. The full cash will be spent up front, but the P&L will only show 1/10th of that cost each year for 10 years. Profit will be much higher than cash for that reason. This is why many analysts prefer to look at Earnings (profit) before depreciation – it is going to be a better proxy for operating cash flows.

Interpreting Net Cash Flow in Finance

Analysing net cash flow is a critical exercise in finance, as it provides valuable insights into a company’s financial health and operational efficiency. Here are some key considerations when interpreting net cash flow:

Positive Net Cash Flow: A positive net cash flow indicates that a company is generating more cash than it is spending, which is generally a favourable sign. It suggests that the business has sufficient liquidity to meet its obligations, invest in growth opportunities, and potentially distribute dividends to shareholders.

Negative Net Cash Flow: A negative net cash flow implies that a company is consuming more cash than it is generating, which can be a cause for concern if the trend persists. This situation may require the business to seek external financing or adjust its operations to improve cash flow.

Cash Flow Consistency: Evaluating the consistency of a company’s net cash flow over multiple periods is crucial. A consistent positive net cash flow indicates a stable and sustainable business model, while erratic or declining cash flows may signal underlying operational or financial challenges.

Cash Flow Allocation: Analysing the allocation of cash flows across operating, investing, and financing activities can provide valuable insights into a company’s strategic priorities and growth trajectory. For instance, a significant cash outflow from investing activities may indicate acquisitions or capital expenditures for expansion.

We have also written a knowledge article on Free Cash Flows – again many definitions! But do look at that article to get a more in-depth feel for which cash flows matter, depending on what you want to analyse.

Example Analyses for Net Cash Flow

To illustrate the practical application of net cash flow analysis, let’s consider two hypothetical companies, Company A and Company B, operating in the same industry.

Company A:

- Net Income: £5 million

- Net Cash Flow: £2 million

Company B:

- Net Income: £3 million

- Net Cash Flow: £4 million

Based on the net income figures alone, Company A appears to be more profitable. However, when considering net cash flow, Company B emerges as the stronger, generating a higher cash surplus of £4 million compared to Company A’s £2 million.

This raises further questions – For example, for Company A: why is net cash flow so low compared to profit? It seems to be investing heavily in working / fixed assets. Had it already raised capital in the previous year to do this, or is it now under financial strain? A more holistic look at the financials is needed – e.g. prior year accounts to look at movements in the balance sheet and previous year cash flows. Also, is company B actually ‘stronger’?

It may be for now, but the higher net cash flow may indicate it is under-investing. Equally, it may be more conservative with dividend payments, saving the cash to reinvest next year. Looking a net cash flow is only the tip of the iceberg.

This example highlights the importance of analysing net cash flow, but only in conjunction with other financial metrics. While net income provides valuable information about profitability, net cash flow offers a more comprehensive understanding of a company’s liquidity and operational efficiency.

Another scenario could involve a company with negative net income but positive net cash flow. This situation may arise due to non-cash expenses, such as depreciation or amortization, which are deducted from net income but do not directly impact cash flow. In such cases, analysing net cash flow can reveal the underlying strength of the business’s operations and its ability to generate cash.

Limitations of Net Cash Flow Analysis

While net cash flow analysis is a valuable tool for assessing a company’s financial health, it is essential to consider its limitations:

- Non-Cash Transactions: Net cash flow does not account for non-cash transactions, such as depreciation, amortization, or stock-based compensation, which can impact a company’s profitability without affecting its cash position.

- Accounting Manipulation: Companies may manipulate their cash flow statements through accounting practices such as delaying payments to suppliers or accelerating collections from customers, which can temporarily inflate net cash flow. Companies can only smooth over the cash for a limited time – so year-on-year analysis is absolutely essential to get a proper feel for the cash flow implications.

- Short-Term Focus: Net cash flow analysis provides a snapshot of a company’s cash position at a specific point in time and may not reflect long-term financial health or sustainability.

Complementary Financial Metrics

To gain a more comprehensive view of a company’s financial health, net cash flow analysis should be used in conjunction with other financial metrics, such as:

- Free Cash Flow: Free cash flow measures the cash available to a company after accounting for capital expenditures, providing insights into its ability to generate cash for discretionary purposes.

- Cash Conversion Cycle: The cash conversion cycle measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales, indicating operational efficiency.

- Cash Flow Statements: Cash flow statements provide the data necessary for net cash flow calculations, detailing the inflows and outflows of cash from operating, investing, and financing activities.

As the lifeblood of any enterprise, positive and consistent net cash flow is a critical indicator of a company’s long-term sustainability and growth potential. However, it is essential to consider the limitations of net cash flow analysis and use it in conjunction with other financial metrics for a more comprehensive assessment of a company’s financial performance.

By conducting thorough net cash flow analyses and considering complementary financial metrics, stakeholders can gain a holistic understanding of a business’s financial health, enabling them to navigate the complexities of the financial landscape with confidence.