Market Momentum Tracker Analysis – 24-06-24

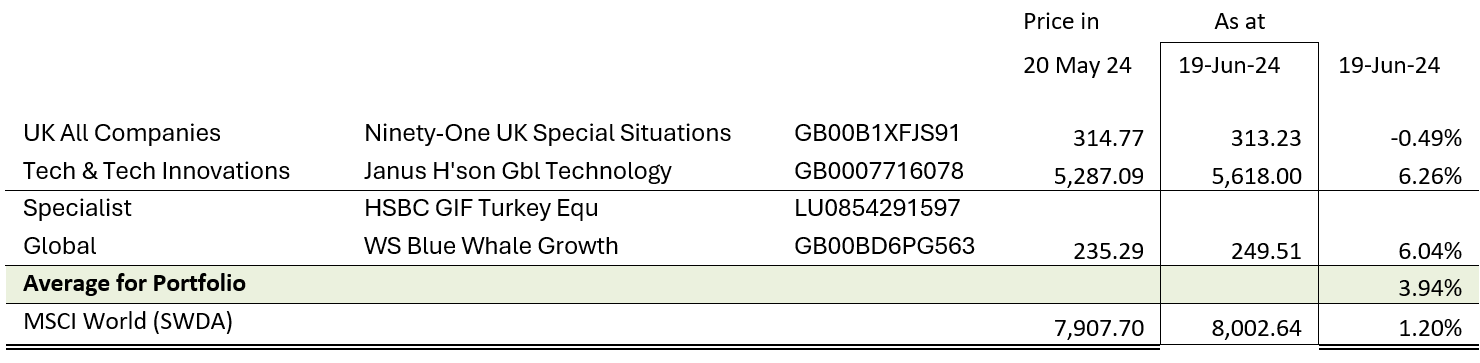

Following our initial blog, we’ve started setting up monthly portfolios. The approach we took was to make it diversified – taking top performers from four different segments to reduce volatility. This presents real problems at the moment as momentum is so concentrated in technology. This feeds through to sectors like “Global”, which encompasses a range of strategies with many with names like “Global innovation”. These, like the MSCI World index, which we’ve taken as our benchmark, is also US focused and with a big allocation to technology.

Our first portfolio only had only three funds as the HSBC Turkey fund wasn’t available to retail investors in the UK through either Hargreaves Lansdown or Interactive Investor.

The performance was mixed – the announcement of the UK elections cooled this segment very quickly. Otherwise technology was the big focus – with Blue Whale having nearly a 40% allocation to technology. The “fund of funds” has significantly outperformed.

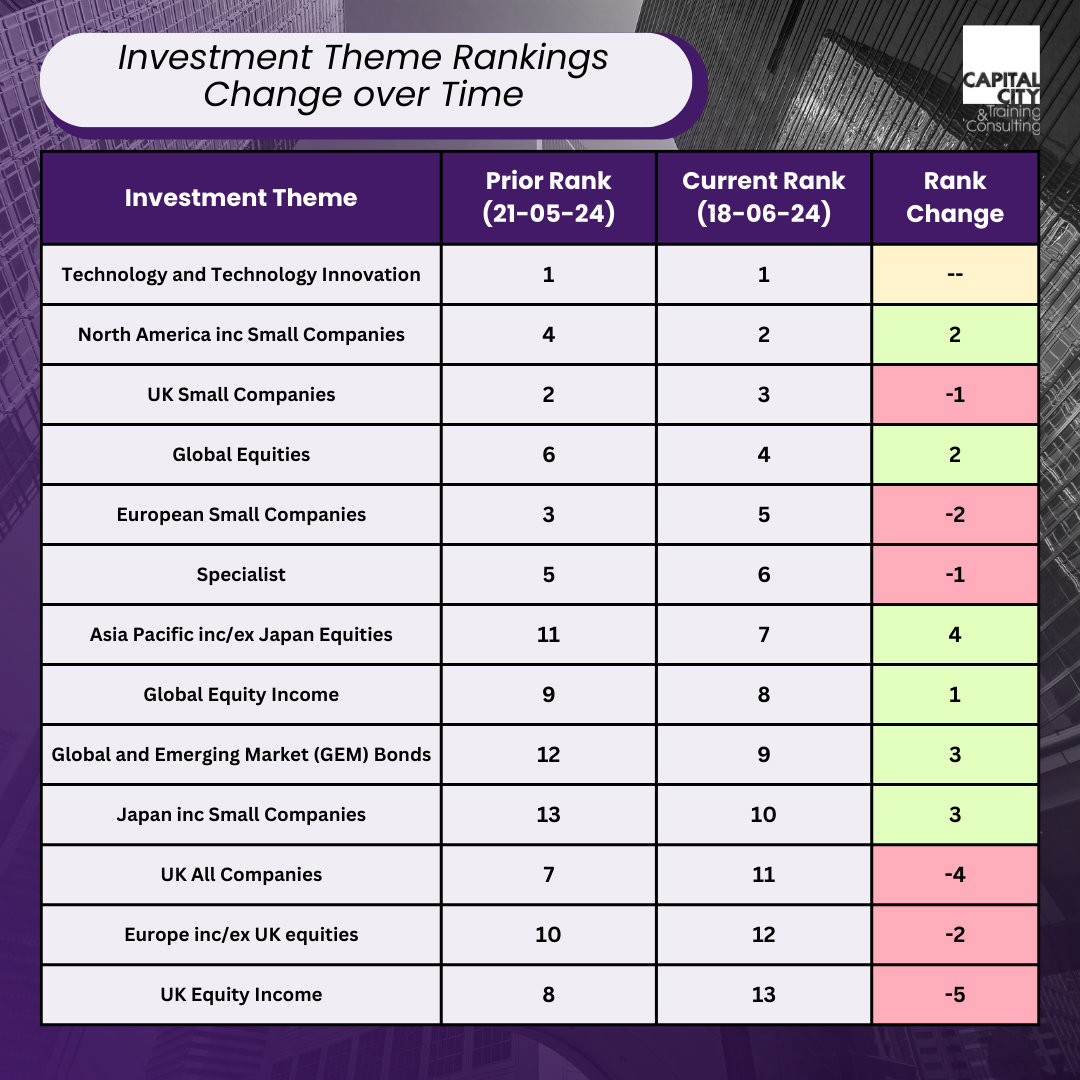

Overall Change in Investment Themes

Turkish Prospects

It is a shame that the Turkey fund wasn’t available. Turkey was extremely problematic for a number of years as it followed unconventional economic policies – keeping interest rates down in the face of rampant inflation. Finance ministers came and went. Inflation was rampant and the currency crashed.

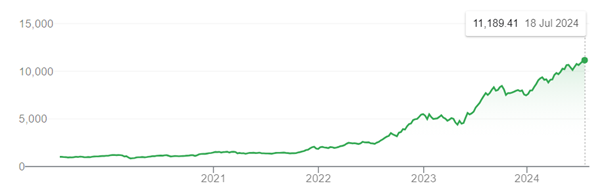

The stock market looks to have performed spectacularly but the impact on the currency is terrible.

From the end of 2016 to the end of 2021, the index has risen over ten-fold in Turkish Lira terms. In real terms, after taking account of inflation it has more than doubled. If we look in US$ terms, the story is very different: US$100 invested in the BIST100 index at the end of 2016 would have been worth US$62 five years later, even though the index had doubled in Turkish lira terms. The Turkish lira has lost 74% of its purchasing power against the dollar.

Investors face the tantalising prospect of a stabilising in the lira. International inflows have been dramatic.

Technology Leaders

It will be interesting to look at Technology performance over the next month – to 19th July to see what impact Nvidia will have. The company’s shares corrected starting on the 18th of July, falling over 10%.

Technology is still performing, but interestingly so is Biotechnology. The sector had a terrible run after the end of the COVID crisis, with the Russell biotech index falling 80% from its peak. This will be interesting to watch.

Indian Election Correction

India had a small correction after the surprise loss by Narendra Modi of his majority, but this soon retraced.

Marlborough Far East Growth fits into the same narrative, its biggest sector allocation is to technology – albeit not the “magnificent 7” and its biggest country allocation is to India. So we are not really diversified.