Working Capital: Definitions, Formulas, Examples

Working capital is a vital concept in corporate finance and business management. It represents the liquid assets companies need to fund day-to-day operations and pay short-term obligations. Having adequate working capital ensures a company has sufficient cash flow to meet its current financial obligations and unforeseen expenses that may arise.

Article Contents

Key Takeaways

| Takeaway | Description |

| Definition of Working Capital | Working capital refers to a company’s current operating assets (e.g. inventory, receivables) minus its current operating liabilities (e.g. trade payables). It represents the liquid assets needed to fund day-to-day operations. |

| Importance of Working Capital | Adequate working capital ensures a company has sufficient cash flow to meet short-term obligations and fund operations. Monitoring working capital helps assess operational efficiency. |

| Working Capital Formula | Working Capital = Inventory + Receivables – Trade Payables |

| Working Capital Ratios | · Inventory Days: Inventory / Cost of Sales * 365

· Days Sales Outstanding (DSO): Receivables / Revenue * 365 · Days Payable Outstanding (DPO): Payables / Cost of Sales * 365 |

| Financing Strategies | Options include overdraft facilities, credit cards, factoring, asset-based lending, and short-term business loans. The optimal mix balances cost, flexibility, and risk. |

| Other Liquidity Ratios | · Current Ratio: Current Assets / Current Liabilities

· Quick Ratio: (Current Assets – Inventory) / Current Liabilities · Cash Ratio: Cash / Current Liabilities · Operating Cash Flow Ratio: Operating Cash Flow / Current Liabilities |

What is Working Capital?

Working capital, also called net working capital, refers to a company’s current operating assets minus its current operating liabilities. Just calling it “Current assets less current liabilities” is too generic. For example, tax assets or liabilities are not operational and not included in working capital.

Think of it this way. If you set up a retail business, you would firstly have to invest in the Fixed Assets such as property, fixtures & fittings, even a website. This would require capital (borrowings or equity). But also, you would need to buy inventory – to keep on the shelves, and a stock in a warehouse / storeroom. Then, when the inventory is sold and starts to move, you need to invest to replace it. Yet if you have sold on credit to your customers, you still haven’t earned any cash. So inventory and receivables need funding! This is your working capital requirement. To the extent you have purchases on credit from your suppliers (accounts payable) this reduces the working capital requirement.

Monitoring and managing the working capital elements of a business help us evaluate its operational efficiency. Is inventory too high or rising out of line with revenue? Are receivables rising faster than revenue, indicating the business is not so efficient at collecting cash from its customers, or it is having to give extended credit terms to achieve sales growth?

Working assets need funding – being a use of cash. So, this is all a part of liquidity and efficiency analysis.

Working Capital Formula

The formula for calculating Working Capital is:

Working capital = Inventory + Receivables – Trade Payables

For example:

- Inventory = £50,000

- Receivables = £40,000

- Trade Payables = £30,000

- Working Capital = £50,000 + £40,000 – £30,000 = £60,000

This company has £60,000 invested in ‘net working assets’ or working capital, Whether this is good or bad is a relative assessment – we need to compare to other companies with similar business models, as well as evaluating over time to see how the working capital has changed – and typically it should rise in line with revenue.

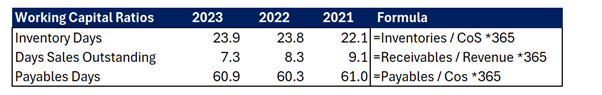

Working Capital Ratios

Working capital ratios can be used to assess the efficiency of a company’s investment in working assets and spot any anomalies that may need investigating.

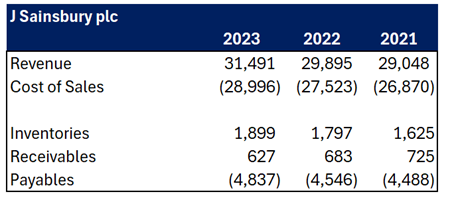

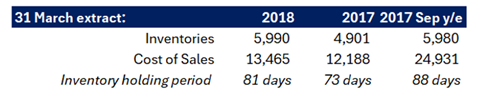

Take a supermarket as a little example – J Sainsbury plc. For a large, stable company such as this, there is an expectation that working capital investment would stay in line with Revenue and / or Cost of Sales. As revenue grows, receivables rise proportionally, as does inventory and payables. The only reason for changes would be a change in credit terms (for customers or suppliers), a change in the mix of products sold (for inventories) or some other questionable reason.

So, we should analyse the levels of working capital alongside changes in revenue:

- Inventory holding period (Inventory days)

- When inventory is sold, the cost passes through the P&L as Cost of Sales. Cost of Sales in the annual report represents 1-year’s worth of inventory passing through the business. Inventory Days shows you how long the inventory takes to turn over if sales continue at a similar rate to that shown in the P&L

- Inventory Holding Period = Inventory / Cost of Sales *365 (note below)

- Days Sales Outstanding (DSO) or ‘receivables days’

- This is an indicator that tells you how many days’ worth of sales are still to be collected from customers. Revenue shows a full year’s worth of sales, so receivables is how many days’ worth?

- DSO = Receivables / Revenue *365

- Days Payable Outstanding (DPO) or ‘payables days’

- Similar to DSO but based on purchases. Purchases are not shown in the P&L, but Cost of Sales is a good proxy

- DPO = Payables / Cost of Sales *365 (note below *)

- * Note: For a stable business model, Cost of Sales will be proportional to Revenue, so many analysts use Revenue as a base, rather than Cost of Sales.

- * Note: For a stable business model, Cost of Sales will be proportional to Revenue, so many analysts use Revenue as a base, rather than Cost of Sales.

For J Sainsbury plc, from the numbers above:

This shows a stable set of working capital ratios, with slightly higher inventory holdings, improving DSO and a pretty constant DPO.

As a cash-business (you cannot leave the supermarket without paying!) the DSO is low and should be. Sainsbury’s has some financial services business which distorts the numbers.

The slight rise in Inventory days might be due to slower moving inventory, or the company holding larger value items at the year end. (e.g. Sainsbury’s sells some simple electronic consumer goods, not just food and drinks e.g. TVs, microwave ovens)

Financing Strategies for Working Capital

Managing working capital involves both optimizing current assets and liabilities, as well as securing financing. The key is that working capital does require funding! It is cash tied up in the business. Common working capital financing options include:

- Overdraft facility – Allows a company to borrow needed amounts from its bank account, up to a set limit

- Credit cards – Provides access to revolving credit lines to fund purchases and operations

- Factoring – Selling receivables to a factoring company to immediately convert to cash

- Asset-based lending – Obtaining loans collateralized by assets like accounts receivable and inventory

- Short-term business loans – Borrowing needed working capital and repaying within 1-3 years

Choosing the optimal financing mix requires balancing costs, flexibility, and risk. Maintaining strong banking relationships and credit rating helps ensure access to cost-effective working capital financing.

From an analyst’s perspective, high working capital is a bit of a ‘red flag,’ and seeing companies accessing capital using factoring services might be seen as a cry for help when liquidity is squeezed. So analysing working capital goes hand in hand with liquidity analysis.

Working Capital and Liquidity Ratios

Key working capital ratios help assess a company’s liquidity and operational efficiency:

- Current ratio – Current assets / Current liabilities

- Quick ratio – (Current assets − Inventory) / Current liabilities

- Cash ratio – Cash and cash equivalents / Current liabilities

- Operating cash flow ratio – Operating cash flow / Current liabilities

- Days Sales Outstanding (DSO) – Receivables / Revenue *365

- Inventory holding period (Inventory days) – Inventory / Cost of Sales *365

- Days Payable Outstanding (DPO) – Payables / Cost of Sales *365

Benchmarking these ratios against historical trends and industry averages helps identify positive or negative working capital management tendencies.

Case Studies and Examples for Working Capital

Working capital analysis can give an indication of problems in a business, or a change in the business model that may be out of line with the strategy.

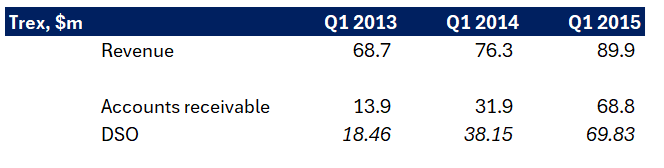

Case 1: Trexx

A decking materials supplier introduced an ‘early buy’ program to its customers to encourage buying its products. The evidence is in the DSO below. Key point: although revenue growth looks impressive, it has clearly offered extended credit to achieve this. This is not a sustainable growth strategy, purely a temporary ‘revenue boost.’ It puts a real strain on cash and will need permanent capital financing. Either that or it will soon run out of cash!

Case 2: Does this look ok? Patisserie Holdings

Patisserie Holdings was behind the infamous high-end Patisserie Valerie business which collapsed into administration in 2019. Have a look at its inventory holdings. Does it make sense to you?

Patisserie and cakes – with a holding period of nearly 3 months? Somethings up with their operating model, or their accounting! Working capital anomalies can be early warning signals for disrupted businesses. It was saved – on a smaller scale – with a management buyout backed by private equity.

Proper working capital management also ensures companies have reserves to withstand emergencies like recessions or supply chain disruptions. Overall, efficiently managing working capital is vital for healthy companies that want to sustain everyday operations while positioning for growth.

Working capital is the critical funding required to support routine business activities. Maintaining adequate working capital ensures liquidity, operational stability, and financial flexibility. But if it gets too high, it means the business is being inefficient and tying up unnecessary funding. Key elements of effective working capital management include optimizing current accounts, securing financing, and monitoring key ratios.