Over many years, as an aside to teaching about convertibles as a product, I’ve had to explain the basis for accounting for them. The accounting has always seemed pretty harmless to me until I recently made a case study out of the online luxury fashion retail platform, Far Fetch (LON:OK60)(NYSE:FTCH). FarFetch issued a series of convertible bonds in 2020. At the same time the stock went on a wild ride from $10 at the start of 2020 to $62.79 at year end! Followed by a collapse in 2021 back to $23.78 at end 2021). At the time of writing, at end 2022, it’s back to $4.50.

The combination of this share price volatility and the rules for derivatives make the accounts unintelligible to a lay person and undermine a lot of conventional risks metrics, like debt/EBITDA.

Accounting for convertibles.

A convertible bond is a bond which is, convertible into shares. Typically at a premium to the current share price of 30-40%.

At issuance, the accountants split a convertible in two when they put it on the balance sheet. The “embedded derivate”, the right to convert or “call option”, is valued using an options model. So let’s suppose that on a $100m bond issue, the option is deemed to be worth $14m. Then the debt on the balance sheet would be recorded as a bond of $86m and a separate derivative liability of $14m.

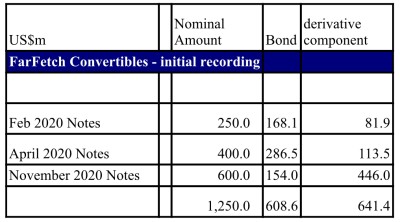

FarFetch’s three bonds were initially recorded as follows:

At the end of 2020, the carrying value was not very different at $617.8m after adjusting for issuance fees and amortisation of the discount represented by the derivative component.

Immediately this gives an investor a problem: If you are trying to calculate a risk measure like Debt/Equity, you will need to be savvy enough to add back the derivative liabilities to get a meaningful number or use the notes to dig out the nominal debt figures – which are twice the balance sheet figures.

It is interesting to note that data providers like CapIQ take the debt figures from the face of the accounts. Ouch!

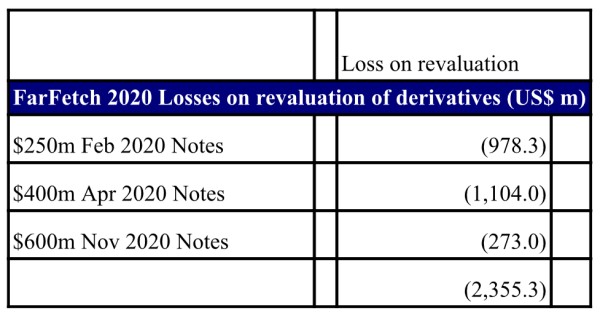

The problems get even bigger when we look at the income statement. FarFetch’s share price rose from an average of $12 in Feb and April when the first two convertibles were issued to $45 when the November converts were issued and then to an eye-watering $62 at the December 2020 year end.

Clearly the mark to market value of the convertible options have increased dramatically. Thinking of this from the company’s point of view, this means that the options are highly likely to be exercised, and there is an opportunity cost to having given away “cheap” options. The company potentially could have issued stock at the peak of $62 for the year. Instead it will potentially issue shares on conversion at an effective price of $12.25, $16.13 and $32.29 for the Feb. April and November notes, respectively. The effects of the rise on the option value though has an odd effect on the company:

More accounting for derivatives.

The accountants revalue the options using their Black/Scholes or binomial model and the increase in value of the option- the opportunity cost of issuing “cheaply”- is taken though the P+L as a loss. To quote the accounting policy:

“Derivatives embedded in other financial instruments or other host contracts are treated as separate derivatives when their risks and characteristics are not closely related to those of the host contracts and host contract are not carried at fair value, with unrealized gains or losses reported in the statements of operations. Embedded derivatives are carried on the balance sheet at fair value from the inception of the host contract. Changes in fair value are recognized in the statements of operations during the period in which they arise.”

The impact of this massive revaluation was huge. In 2021, the share price fell back, halving to $33.92 by the 30th of Dec 2021. The revaluation was largely reversed.

Why is this a problem?

Profitability is distorted

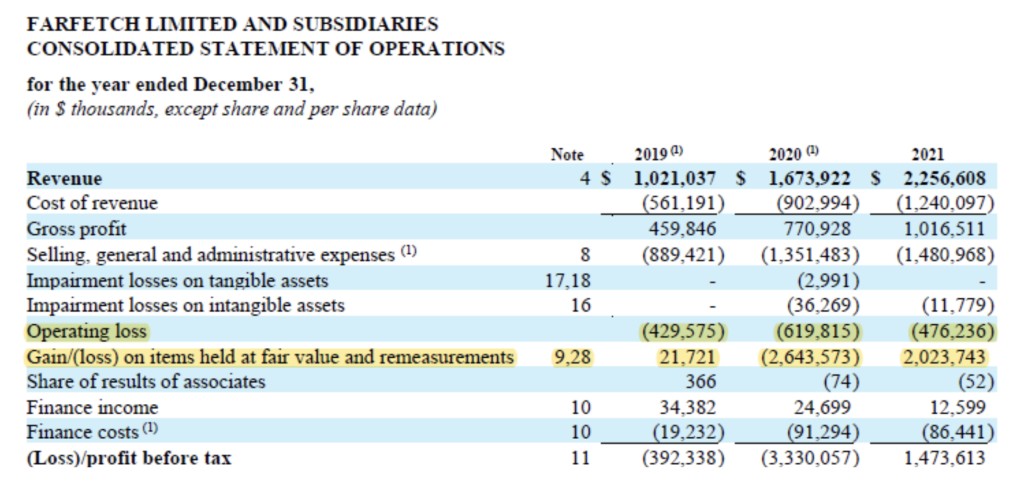

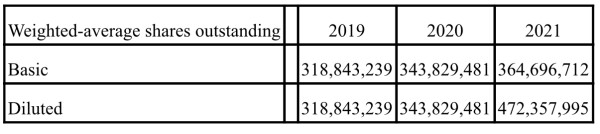

The impact of the revaluations give a completely misleading picture as to what is going on. In terms of understanding profitability and whether to buy the stock, the revaluations need to be ignored. The important thing to consider is the dilution from potential new share issuance.

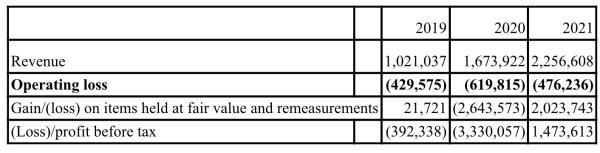

In 2020, FarFetch is still massively unprofitable with an (albeit improved) operating margin of -21.1%. A superficial look including the impact of the derivatives is that it has broken through from losses to dramatic profitability. Derivative revaluations turn an operating loss of $(476)m into a profit of $1,473m!

What does it all mean?

FarFetch superficially looks to be on a positive trend – with revenue growing at 35% and operating margins improving thorough lockdown. The growth is flattered by lockdown as people shop more from home and the company assimilates several acquisitions. It begs the question how has it fared in 2022? The obvious opportunity for FarFetch in 2022 was to massively cut costs – integrating several e-tailing platforms into a single technology platform, consolidate logistics and get the benefits of scale and integration. Perhaps even make an operating profit?

Unfortunately, the company’s top line has stagnated post COVID as people move back to the high street and we face higher interest rates. It’s operating margins far from improving deteriorated in the 9 months to Sep 2022. Perhaps the company, like many start-ups lacks the management culture to make the company profitable – and fire half the staff, as Elon Musk has at Twitter. It is interesting to speculate on the commercial rationale of the platforms last convertible buyers – Richemont and Alibaba. Are these two now dominant lenders going to find themselves in a position to buy FarFetch out of bankruptcy in two or three or four year’s time when it has burnt all of its cash and is still not profitable? Have they loaned 100¢/$ to end up owning the company by buying up the other convertibles at 20-30¢/$ and exchanging their bonds for voting stock?

Watch this space, but maybe don’t buy the stock!